We know that college costs are increasing, but what’s harder to find out is where the money is going. The American Council of Trustees and Alumni on Wednesday launched a site that makes it easy to track how your hard-earned tuition dollars are spent: HowCollegesSpendMoney.com. It’s geared toward college trustees, lawmakers and policy wonks, who can use the site’s data to lobby for or against government spending for higher education or to compare their institution to others. But parents....

Read MoreStudent loans, interest payments, and taxes: three things that have scared many people for years now. Read on to learn how these things can benefit you. If you made federal student loan payments in 2018, you may be eligible to deduct a portion of the interest paid on your 2018 federal tax return. This is known as a student loan interest deduction. Don’t miss out on this opportunity to make the money you’ve paid work for you! Below are some questions and answers to help you learn more about ....

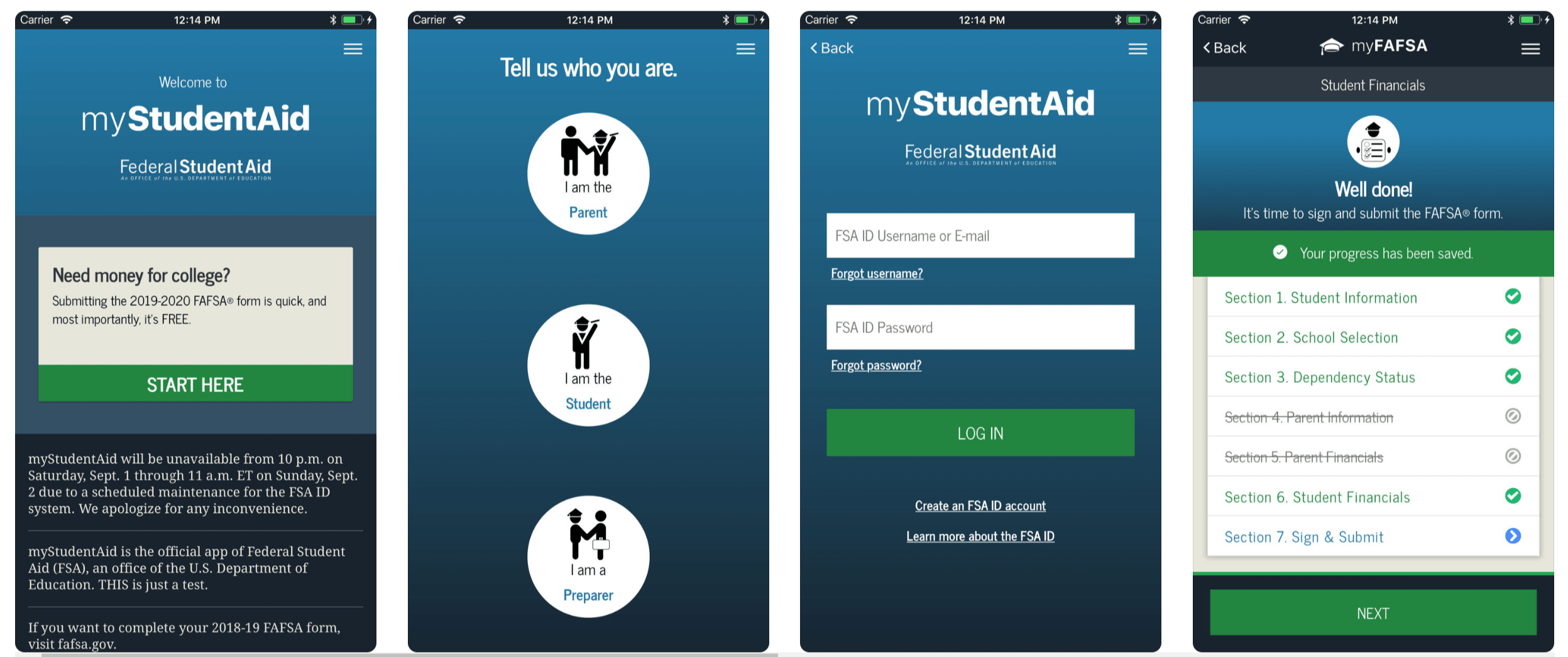

Read MoreAs part of its continued efforts to modernize and improve the quality of services provided by Federal Student Aid (FSA), the U.S. Department of Education this week launched its first-ever mobile application. The myStudentAid app will allow students and parents to easily and securely complete the 2019–20 Free Application for Federal Student Aid (FAFSA®) using the app's myFAFSA component. "The future of the FAFSA is here," said Education Secretary Betsy DeVos." "Now, students and their familie....

Read MoreCollege essays are critical for your families’ kids to get into their target schools and earn scholarships. Yet, most students struggle with their essays – writing about uncompelling content and using a poor structure. Our new partner, Prompt, is the easiest way to provide your families with affordable, expert support on essays. Prompt has reviewed tens of thousands of college essays, helping thousands of students gain acceptance to their dream schools while earning millions in scholarships....

Read More