All you hear in the news is that a college education is mandatory for a good job. There’s no doubt in my mind that statement is true. This is why admissions enrollment today is the highest ever, which of course why college costs are the highest ever. Supply and demand. The rising cost of college never seems to end. If you are retired, the average increase in your social security benefit over the past few years has been negligible. Family incomes have not gone up much either, which is why the....

Read MoreAre your clients looking to go to a college out-of-state for in-state costs? A public college in another state costs 2-3 times for out-of-state students compared to the in-state prices. Being considered an in-state student will make those out-of-state schools more affordable. If the student can establish in-state residency, the cost of college can be reduced by eliminating the out-of-state tuition. In many states, out-of-state tuition can double or triple the cost of attendance. The four ....

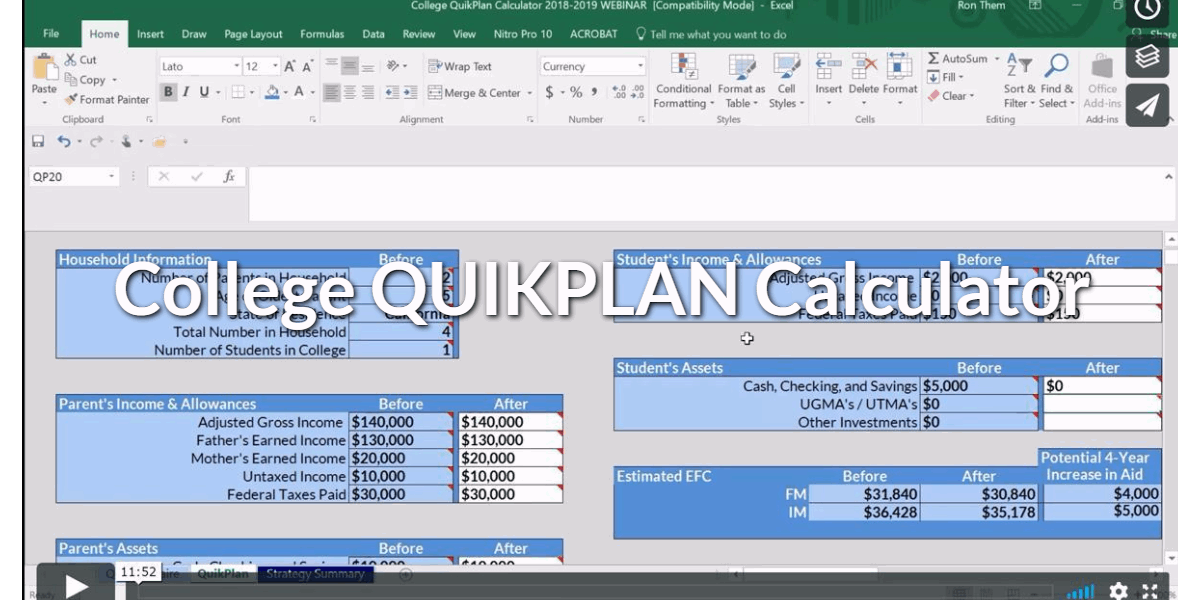

Read MoreToday I’m going discuss a Microsoft Excel calculator that I developed called the College QUIKPLAN Calculator. It’s included as part of your membership and every Certified College Funding Specialist can use this calculator to do some quick before and after college financial planning with your prospective clients. I developed it for financial advisors who want to demonstrate how the repositioning of income and assets can dramatically increase the prospective client’s grant and scholarship of....

Read MoreDo you have clients that are struggling to pay back their student loans? They’re not alone. According to the Consumer Financial Protection Bureau, nearly 25% of the more than 41 million people with student loans have trouble paying back their college debt. Student loans are the second largest form of consumer debt in the United States, after mortgages. The total amount of outstanding educational loans has exploded in the past decade, going from $600 billion in 2007 to $1.4 trillion today. In ....

Read More