Convert Prospects Into Clients Using The College Quikplan Calculator - A “Here’s What I Can Do For You” Analysis Tool

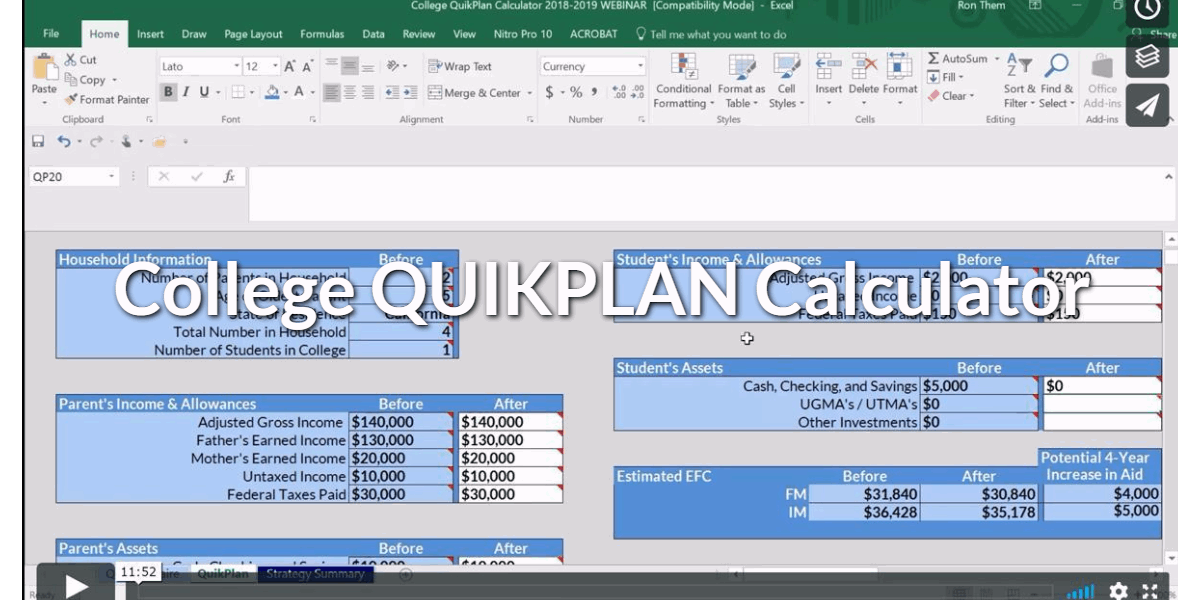

Today I’m going discuss a Microsoft Excel calculator that I developed called the College QUIKPLAN Calculator. It’s included as part of your membership and every Certified College Funding Specialist can use this calculator to do some quick before and after college financial planning with your prospective clients. I developed it for financial advisors who want to demonstrate how the repositioning of income and assets can dramatically increase the prospective client’s grant and scholarship offerings by the college and to steer the conversation to the financial issues.

The College QUIKPLAN Calculator is different than our Simple EFC Calculator because you can develop a before and after analysis for four different colleges using your own financial strategies. You cannot do that with the Simple EFC Calculator, as it only gives you an initial Expected Family Contribution for one college.

In my experience, before getting in too deep with a prospect, you just want to lay out a quick, “here’s what I can do for you” analysis. If you have the same experiences, then the College QUIKPLAN Calculator is a great tool to use. It’s the perfect way to begin the financial conversation with a family.

Once you find the prospect has an interest to continue the college planning conversation deeper, then you can move on to more elaborate tools like the Answers4College Blueprint to run more comprehensive college comparison analysis.

The College QUIKPLAN Calculator allows you to:

- Compare four college’s side-by-side,

- Estimate the amount of money the family will need to come up with each year,

- Gives the family an idea of their financial aid eligibility,

- Sets up the advisor to ask the question, “Now that you have an idea how I can help you, would you like to take the college financial planning process further?”

So how does the College QUIKPLAN Calculator work? What are the features & benefits? Watch the video I made that provides an overview.

Posted by Ron Them

He is a former Chief Financial Officer of a Fortune 500 company and currently owns his own financial advisory company specializing in cash flow planning for business owners and executives. He developed the Cash Flow Recovery™ process that uses cash flow management principals to increase asset value and build wealth for business owners.

He is also the originator of several software calculators to help advisors and families make college affordable, including:

* College QuikPlan EFC Calculator

* "Find the Money" College Cash Flow Calculator

* College Debt Reduction Calculator

Ron has been quoted in U.S. News and World Report, Kiplinger's Personal Finance, Smart Money, Financial Advisor Magazine, Small Firm Profit Report, Practical Accountant, LIMRA's Market Facts, Senior Advisors Magazine, HR Magazine, BenefitNews.com, Employee Benefit News Magazine, ProducersWeb.com, Entrepreneur Magazine, Insurance Selling Magazine, CollegeNews.com, The Christian Voice, and Columbus CEO Magazine.