When parents divorce, a big concern is the children and how to pay for future college expenses and retirement at the same time. Parents with younger children can plan ahead and make contributions to a college savings fund before the child graduates high school. However, parents with children about to attend college have a more immediate concern when drawing up a college support agreement. This is where a financial advisor who is a Certified College Funding Specialist (CCFS®) can become invalu....

Read MoreSome ways to think like an investor Going to college pays off, on average. But to maximize the chance that a college education offers a satisfactory return, students need to think like investors. They need to carefully consider which degrees pay off and why, and they need to make informed decisions about the type of degree and major they select. Investors in financial markets consider many complex variables to mitigate risks and maximize returns. Investing in college is no different. In a re....

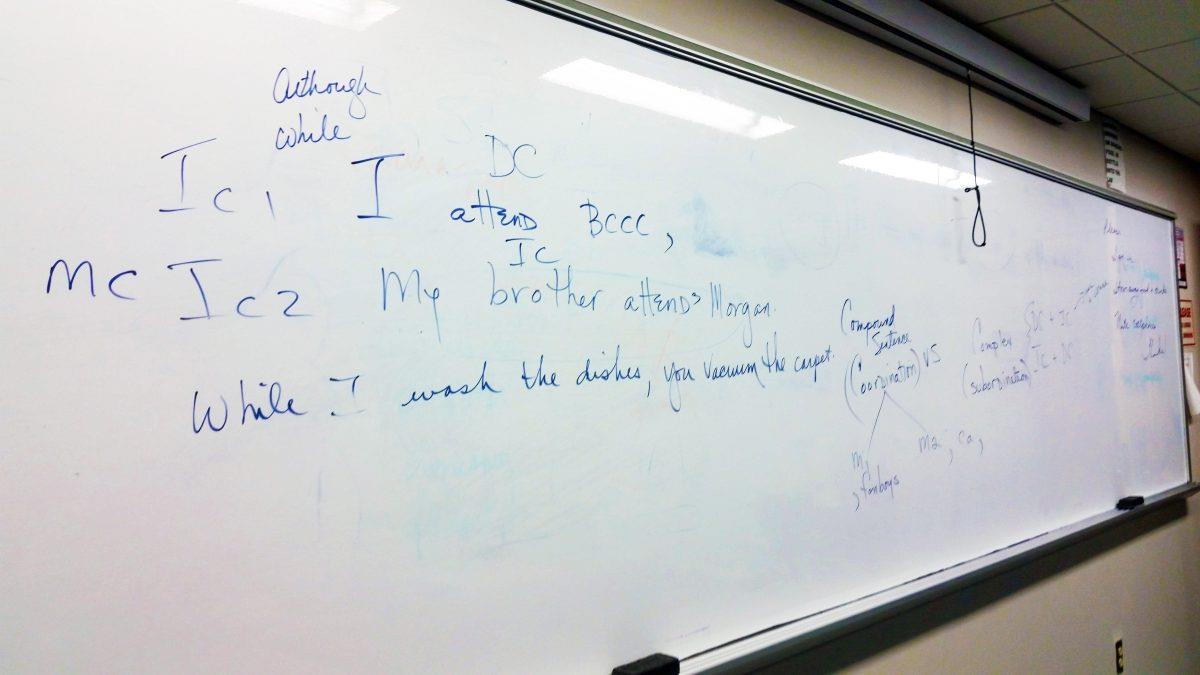

Read MoreAt more than 200 campuses, more than half of incoming students must take remedial courses BALTIMORE — The vast majority of public two- and four-year colleges report enrolling students – more than half a million of them–who are not ready for college-level work, a Hechinger Report investigation of 44 states has found. The numbers reveal a glaring gap in the nation’s education system: A high school diploma, no matter how recently earned, doesn’t g....

Read More