You Can Use College Funding To Sell Life Insurance, Here's How

College funding is a unique niche for financial professionals.

To succeed in the niche market of college financial planning, advisors must separate themselves completely from their competition. Do you have clients who will send their kids to college in the next few years? How about grandparents who want to help their grandkids pay for their education? If so, financial advisors should understand the importance of protecting their clients’ assets and income while planning for the high costs of college.

The average cost of a public university next year will be no less than $30,000 a year. Private colleges average $55,000 per year, and elite schools like New York University can exceed $70,000. Very few clients can afford tuition out of their income, and so they obtain money from their savings and investments or borrow to oblivion. By calling clients, meeting with them in your office, and starting the process of planning for these high college costs, your dedication to college financial planning will help you retain clients as well as attract new ones.

Every year, there is a new class of students whose families are preparing to finance their children's college education, and this is can be an endless source of new leads within your community. So, ask yourself: “How is your current financial practice?” “Do you have a continuous flow of clients into your office?” “The DOW’s never been higher, but what about your income?”

If the answer is not ideal for any of these questions, then a better plan of attack is necessary. All young financial advisors, as well as old and established advisors, should offer college funding as a service within their financial practice.

College is not all about 529 plans.

Contrary to popular belief, college financial planning is not all about 529 plans, and many 40- to 50-year-old clients do have money and earn more as they age. You may sell annuities to clients with high school students who want to pay for college with grants and scholarship aid, as well as cash value life insurance to younger clients with elementary and middle school students who want to save for college, all without wrapping them up in the 529 quagmires.

Cases for annuities and life insurance.

Appropriate types of annuities and life insurance depend directly on the client. An advisor cannot, for example, sell cash value life insurance or annuities with high surrender charges to clients with high school children simply because the costs are too high, even if the client receives more financial aid for moving their money to exempt products.

However, many advisors sell “no-load” or “low-load” annuities, which generally provide an opt-out feature after one year. While they may only provide 1% for compensation, this compensation may also last four to five years if a client receives a good grant-in-aid package while the student attends college. Other clients may be willing to move all their investments with you after the college years are over; in any case, solving the high costs of college allows advisors to develop innumerable steadfast relationships with clients.

Some younger clients with elementary and middle school students want to save for college but are unsure of how to start. They may receive something in the mail about 529 plans, but may also be reluctant about the money they could lose if they must access the 529 before college. For these younger clients, cash value life insurance is the ideal product: while the money put into a 529 plan is difficult to access without taxes, even in the event of an emergency, the money put into cash value life insurance can be accessed at any time.

A young family generally means lower costs to insure, so more of the money goes toward cash value, and younger children mean the cash value has more time to grow. In the meantime, if one or both breadwinners becomes ill or dies, the children are covered. If money is needed for an emergency, the cash value can be both accessed and re-deposited tax-free, all while the life insurance is not susceptible to market-declines at inconvenient times. Cash value life insurance, if structured properly to keep costs minimal, can be an outstanding savings vehicle for not only college but also much more.

I reached out to one of our Certified College Funding Specialists, Josh Sterling, and asked him to help me provide some example cases of families that wish to save or pay for college, as well as how others can design financial products to help these families not only pay for college but also cover their retirement costs.

I asked him to use examples that are typical of his clients and what the average Certified College Funding Specialist would see in their practice. The goal in all examples is for families to not only fully fund the cost of their children’s education but do so in a way that also provides a plan for the family to recover the college costs, protect their funds, and add to their retirement.

NOTE: If you need clarity on any of the products discussed in these cases, please contact Josh Sterling, CCFS® directly, he has agreed to help any CCFS® with products and case design. The ACCFS does not sell or promote any financial products or companies.

CASE #1

This is a scenario of “buy term life insurance and invest the difference.” It’s also important to understand the drawbacks of this strategy, as term life insurance can become more expensive later in life when coverage is needed the most.

Here, we have a young family with two young children. Example A demonstrates investing the traditional way, while in Example B the same family uses life insurance as the primary savings vehicle:

Example A: Traditional 401(k) & 529 Savings Plans

Here, we have a 32-year-old mother and father earning $185,000 per year from the father’s online business he started five years ago. They have two children, ages 4 and 2. They invest $700 per month into their company 401(k) plan. They purchase a $500,000, 20-year term insurance policy for $50 per month and save $450 per month in a 529 college savings plan until the kids go to college in 16 years. Their total financial expenditures for retirement, insurance, and college for the kids amount to a monthly cost of $1,200 ($700 + $50 + $450).

Twenty years later, both parents are now age 52. Both children are grown, now 24 and 22, and out of college and the house. College is paid for, and the parents have no debts. At age 65, if they have earned a continuous 5% return for the last 33 years, they will have about $703,000 in their 401(k) retirement fund. If they plan to withdraw the money over 25 years, to age 90 - assuming the same 5% return - they can withdraw $43,500 each year, assuming a 25% federal, state, and local income tax. However, this financial plan has no contingency for unforeseen drawbacks, such as catastrophic medical events or early death of the breadwinner.

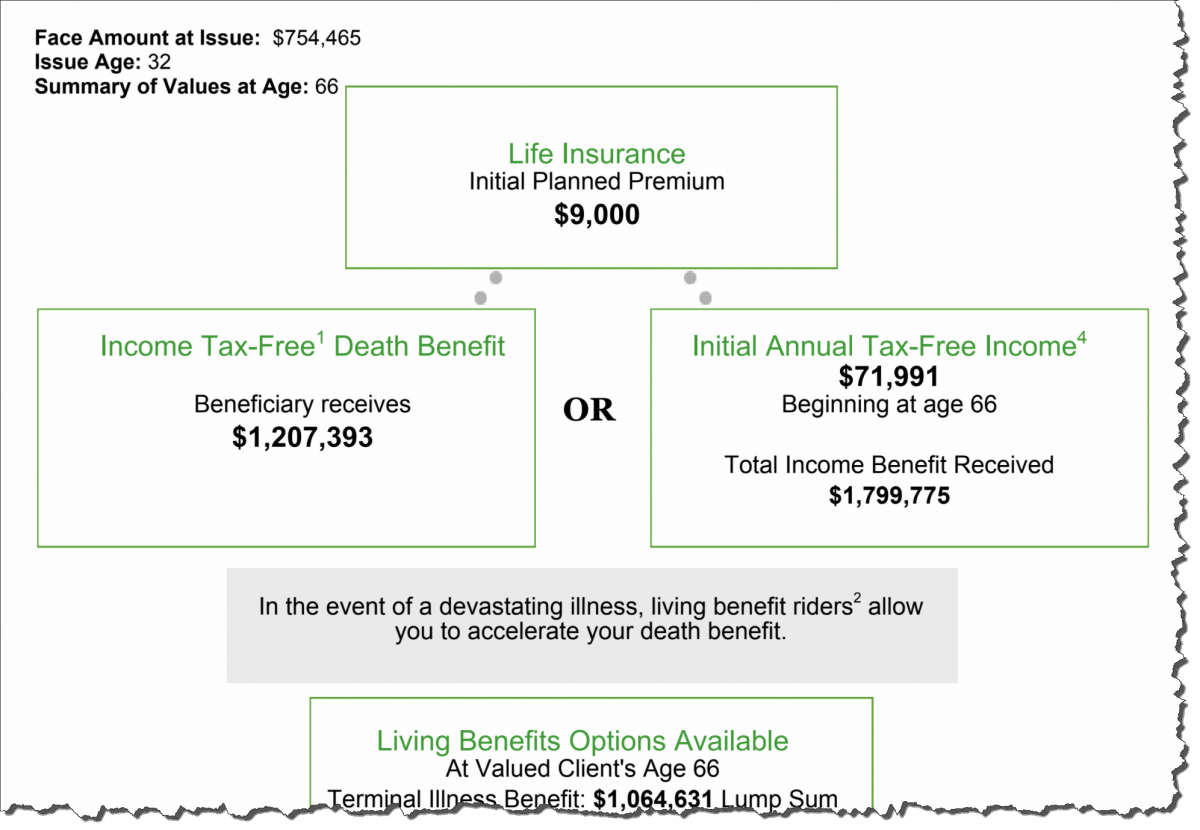

Example B: Alternative Personal Retirement & College Savings Plans (IUL)

This example features LSW/National Life Group FlexLife II Indexed Universal Life which contains living benefits and protects the client’s assets and retirement from death and catastrophic medical events - as the family’s main savings vehicle.

The same 32-year-old family invests the entire $750 per month of income (replacing the 401(k) and term insurance) into LSW/National Life Group FlexLife II Indexed Universal Life policy. The initial death benefit placed on the father is about $300,000. They contribute the same $450 per month in a 529 college savings plan.

(Please note that the entire $1,200 could be placed into the IUL policy with college expenses withdrawn/borrowed from the policy. For purposes of this example, we kept college and retirement separate.)

Twenty years later, both parents are now age 52. Both children are grown, now 24 and 22, and out of college and the house. College is paid for, and the parents have no debts. At age 66, they can retire with an annual income of $71,991 from the IUL policy that will continue through age 90. Furthermore, the entire $71,991 is not taxable, so they can access almost twice as much cash as they would’ve had in the traditional method after taxes.

TARGET PREMIUM FOR CASE #1 = $6,745

Download illustration

CASE #2

Here we have a high school junior that wants to attend a small private college. She has a 3.8 GPA, an ACT score of 32, and an SAT score of 2250. The father is age 42 and a 100% owner of a small C-Corp business.

The following is a list of the family’s finances:

INCOME |

ASSETS |

DEBT |

| Yearly: $150,000 | Home: $450,000 | Mortgage: $350,000 |

| 401k(s): $180,000 | ||

| Money Market: $200,000 | ||

| Savings: $50,000 |

In this case, the student will attend a small private college for a total four-year cost of $200,000 ($50,000/year). The college uses FAFSA only and not CSS Profile, so home equity is not factored into the financial aid formula. However, with an income of $150,000, money market funds of $200,000, and personal savings of $50,000, the family’s “Expected Family Contribution” (EFC) is about $48,000. This means the student will qualify for financial aid (college costs of $50,000 per year minus an EFC of $48,000 = financial aid of $2,000). The goal is to reduce the EFC to about $24,000 so the college may offer about $20,000 in grants and $5,000 in student loans each year; the parents will then pay $2,000 per month to cover the balance of the tuition bill.

The strategy is as follows:

- The father will defer $25,000 per year of income in retained earnings of his C-corp for five years until the student has graduated from college. Income will then be $125,000 per year for those five years.

-

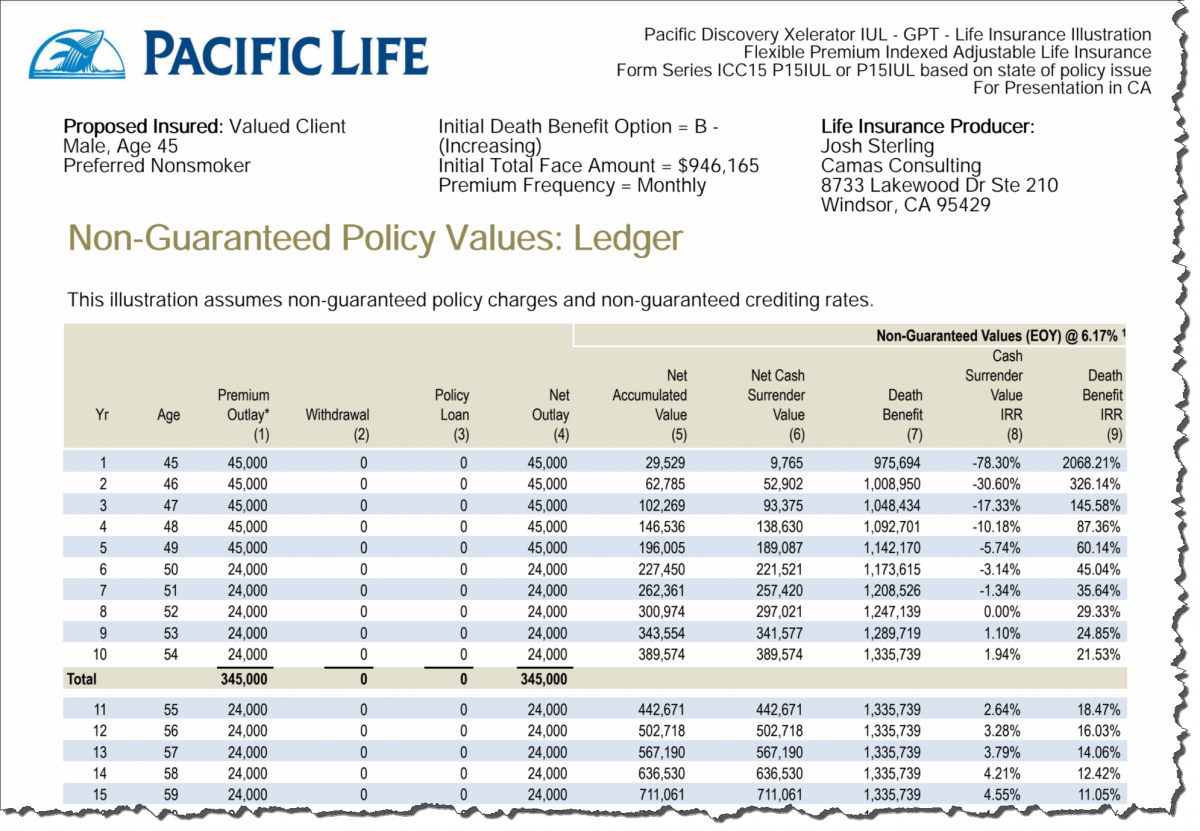

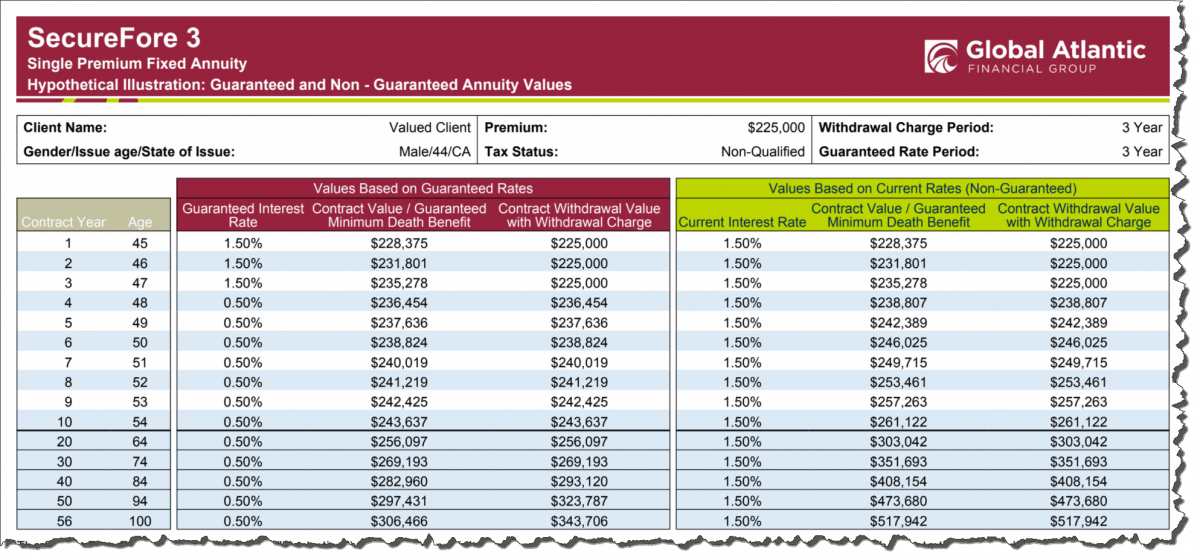

Parents will move $200,000 in money market funds and $25,000 in bank savings into Global Atlantic’s SecureFore 3SM Fixed Annuity (loading the entire amount into an IUL in the first year would MEC the policy).

-

Parents will then gradually move the $225,000 annuity lump-sum (after 3 years) into a Pacific Life’s Pacific Discovery Xelerator Indexed Universal Life (IUL) policy ($45,000 per year over 5 years).

-

By deferring income and moving assets to a short-term annuity and then life insurance, the Expected Family Contribution is reduced from $48,000 to $22,000.

-

Starting in year 6, the $2,000 per month the parents had used to cover the balance of the tuition bill will now be the new premium of the IUL policy.

-

The $2,000/month IUL premiums are stopped at age 65.

-

At age 66, the parents withdraw/borrow $116,269 per year for retirement until age 90 - almost $3 million.

TARGET PREMIUM FOR PDX-IUL IN CASE #2 = $27,000

COMMISSION FOR GLOBAL ATLANTIC’S SECUREFORE 3-YEAR ANNUITY = 2% ($4,500)

Download illustration.

Download illustration

CASE #3

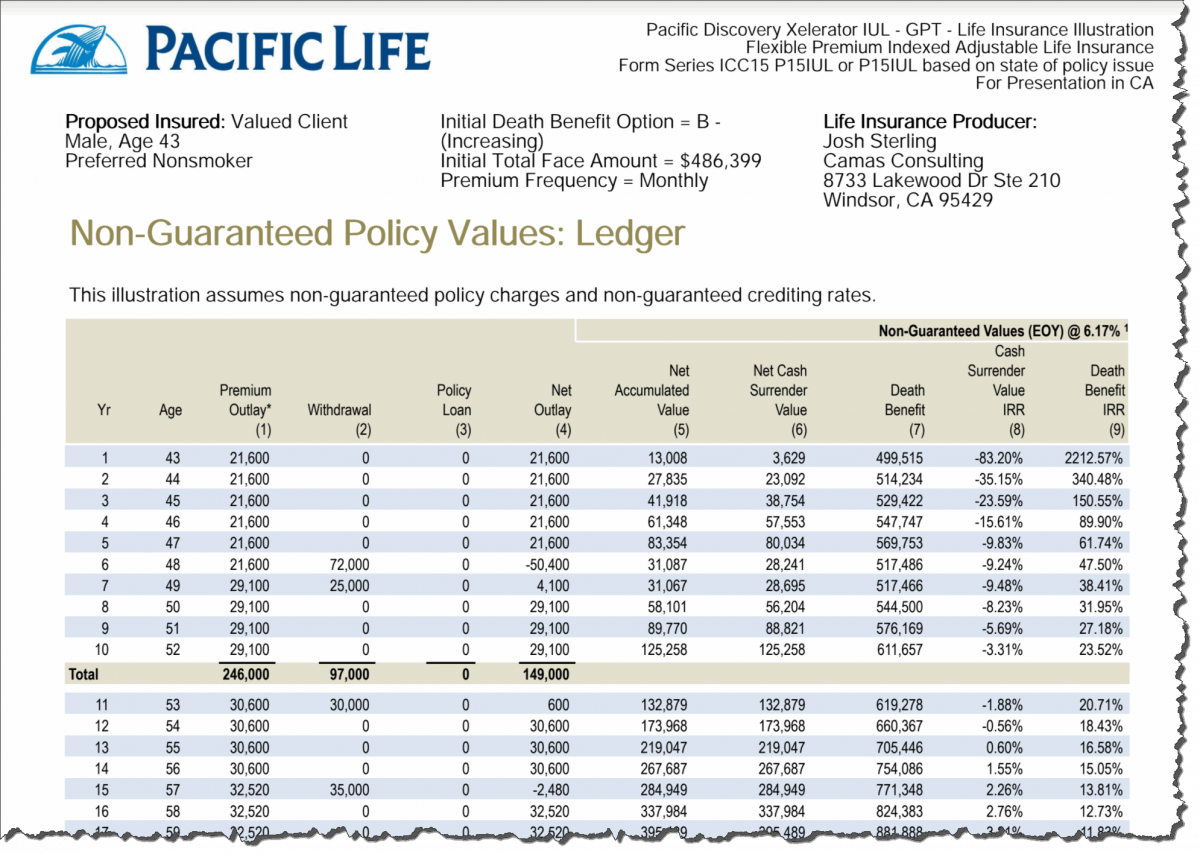

In this case, we have a high school junior that wants to attend a public university. He has a 3.5 GPA, an ACT score of 28, and an SAT score of 1980. His father is a bank executive, age 43.

The following is a list of the family finances:

INCOME |

ASSETS |

DEBT |

| Yearly: $175,000 | Home: $350,000 | Mortgage: $250,000 |

| 401k(s): $80,000 | ||

| CD(s): $40,000 | ||

| Student UGMA: $20,000 | ||

| Savings: $15,000 |

In this case, the student will attend a public university for a total four-year cost of $100,000. Given parental income of $175,000 and that he is attending a public university, there will be no financial aid opportunity, so the student will absorb $40,000 of the education with student loans and college savings (UGMA of $5,000/year + $5,000/year of student loans). The parents will use deferred PLUS loans to fund college for 4 years, and then pay off the $72,000 loan entirely ($60,000 principal + $12,000 interest) at graduation.

The strategy is as follows:

- Years 1 - 23: Parents fund $1,800 per month premium ($21,600/year) into Pacific Life’s Pacific Discovery Xelerator Indexed Universal Life (IUL) policy through age 65.

- Year 6: Parents withdraw $72,000 from the IUL to pay off the PLUS loan.

- Year 7 - 22: Parents fund additional monthly premium into the IUL policy to cover the purchase of a car every four years until retirement.

- Years 7, 11, 15, and 19: Withdrawals are made from the IUL policy for car purchases.

- Year 23: All IUL premiums are stopped at age 65.

- Years 24 - 33: Retirement income of $107,707 per year is withdrawn/borrowed from the IUL policy from ages 66 through 75.

- After age 75, the family will live on Social Security and the bank’s retirement plan.

TARGET PREMIUM FOR PDX-IUL IN CASE #3 = $12,961

Download illustration.

Finding prospective college funding clients.

Whether you’re searching for college funding clients with young children or high school students a year away from college, these prospects are highly motivated because college funding is about both the children’s education and the family’s money. The opportunities to sell financial products to this group are much greater than in the retirement demographic because there is little competition: most financial advisors today are wealth managers, retirement planners, senior advisors, and so on while “college”, by comparison, is wide-open.

Here are some ways to find prospective non-retirement clients:

- Obtains lists of names of families which have younger children who attend private elementary and middle schools. These families are already paying for education for years before college, and private schools can be rather expensive.

- Join groups of young business owners to meet executives who own their businesses or run businesses for their families.

- Work directly with college admissions planners, particularly on financial aspects, to help high-income families get into elite colleges.

- While scholarships are widely available for football and basketball, sports such as baseball, golf, lacrosse, water polo, and soccer offer camps, clinics, courses, and coaching platforms at which you can conduct family seminars and even obtain referrals. Some college financial planners use this method to obtain as many as 50 new clients per year.

- Teach a financial course at a local university and get involved with younger investors and business owners who may benefit from guidance in managing their financial affairs.

- Work directly with divorce attorneys.

- Use social media and Facebook ads to reach specific target markets.

- Use radio advertising to target specific demographics.

- Attend seminars at industry conferences or write columns for local publications and other social media.

Get started with college funding the right way.

When you become a Certified College Funding Specialist (CCFS®), you can enter our Learning Library and access the documents, files, brochures, and presentations you’ll need to help run your college business. But the real power behind college financial planning and the key to selling more insurance are in the “Strategies” area which contains tons of info on topics ranging from how to run a college planning business to strategies for helping your clients save money.

The Strategies section of our Learning Library offers countless methods and ideas to help your prospective clients cut costs such as taxes, household expenses, and even insurance costs and help you create additional cash flow to pay the client’s insurance premium.

Do your prospects?...

- Have low deductibles on their health, auto, or homeowners insurance? Can they increase their deductibles to reduce their current payments?

- Have an old critical illness, disability, or long-term care policy with long-term benefits? (Many new IUL policies already have these features built into one policy, which could dramatically reduce their monthly insurance payments).

- Have an old cash value life policy that can be paid to free up money?

- Have multiple credit cards and charge accounts with large balances and high-interest rates? Could they create additional cash flow by consolidating their debt onto one credit card with a lower interest rate and reduce their monthly credit card payments?

- Have untapped equity in their home that could be used to reduce or even eliminate their debts? Do they have an older mortgage that can be refinanced to achieve a lower monthly payment and free up cash flow? (Mortgage interest is tax-deductible, so they can save on income taxes while reducing or eliminating debt).

- Put money into a Roth IRA, and if so, for the right reasons? If they need more life insurance to protect their family, would a cash value policy which builds tax-deferred and generates tax-free income be more beneficial?

- Put more money into a 401(k) than is matched by their company? If so, why? If they need more life insurance to protect their family, could they create a “hedge” against their 401(k) and save for retirement by funding a cash value policy?

There are hundreds of ideas and strategies available in our Learning Library. No more high-pressure sales pitches: you must simply help the prospect recognize that they may have a future financial problem, allow them to agree that they want to solve the problem, and help them find the extra money they need to effectively solve the problem.

How much easier would it be to set appointments with prospects and make insurance sales if you could demonstrate how they can pay their premiums without spending additional money or changing their lifestyles?

You can see how to make money in college funding, where to find prospective college planning clients, and how to help prospects create cash flow to pay their insurance premiums. All you need to do is get started. Become a Certified College Funding Specialist today!

Disclaimers/disclosures:

- ACCFS is not licensed to promote or sell financial products nor do they endorse specific financial products or companies.

- The illustrations presented are used to help licensed insurance professionals. They are not meant to be used by the general public or end consumer.

- Josh Sterling, CCFS® is licensed to sell financial products in the state of California. The examples presented are based in CA.

- The examples in these case studies are fictitious and are for illustration purposes only. All products were illustrated for the State of California. The products and results are for illustration purposes only and the products and results will vary depending on the goals and objectives of each case and the products used.

- The financial products illustrated in the following case studies can be replaced by many similar products from various carriers and results may vary.

- Products used for purposes of illustration are Global Atlantic’s SecureFore 3SM Fixed Annuity as the short-term annuity, and Pacific Life’s Pacific Discovery Xelerator Indexed Universal Life (IUL) policy , a flexible premium indexed life insurance policy and LSW/National Life Group FlexLife II Indexed Universal Life.

- The Pacific Life’s Pacific Discovery Xelerator Indexed Universal Life (IUL) policy has a Chronic Illness Rider of 2% per month of the death benefit or 24% per year.

- Global Atlantic’s SecureFore 3SM Fixed Annuity has a chargeback of commission if the principal is returned within the first 12 months; after month 13, it is clear of any chargebacks. If returned between year 2 and year 3, there is no surrender charge, but only the principal is returned (no interest).

Posted by Ron Them

He is a former Chief Financial Officer of a Fortune 500 company and currently owns his own financial advisory company specializing in cash flow planning for business owners and executives. He developed the Cash Flow Recovery™ process that uses cash flow management principals to increase asset value and build wealth for business owners.

He is also the originator of several software calculators to help advisors and families make college affordable, including:

* College QuikPlan EFC Calculator

* "Find the Money" College Cash Flow Calculator

* College Debt Reduction Calculator

Ron has been quoted in U.S. News and World Report, Kiplinger's Personal Finance, Smart Money, Financial Advisor Magazine, Small Firm Profit Report, Practical Accountant, LIMRA's Market Facts, Senior Advisors Magazine, HR Magazine, BenefitNews.com, Employee Benefit News Magazine, ProducersWeb.com, Entrepreneur Magazine, Insurance Selling Magazine, CollegeNews.com, The Christian Voice, and Columbus CEO Magazine.