TUITION DISCOUNTS: A LOWER PRICE FOR FAMILIES WITH A GAME PLAN AND A MUCH HIGHER PRICE FOR THOSE WITHOUT

Due to the high cost of college and competition for the best students, many colleges offer discounts from the sticker price in the form of merit scholarships and other non-need based awards. Only the elite, highly selective colleges (Ivy’s) refrain from awarding these tuition discounts to attract the better students, who might not otherwise enroll.

A TUITION DISCOUNTING STUDY published by the National Association of College and University Business Officers (NACUBO) found that over 50% of incoming freshmen received these tuition discounts that reduced tuition by as much as 40%. In many cases, these institutional funds lowered private college tuition costs in the same price range as public universities.

Today, applying to lesser-known (yet still very good) colleges gives the family a real opportunity to achieve a fine education, at a much-reduced cost. Tuition discounting also allows colleges to:

- Increase rating average

- Boost net revenues

- Improve the diversity of the student body

- Attract legacies (students of alumni)

- Attract students from wealthy families (increase alumni contributions)

Why Colleges Offer Tuition Discounts & Incentives

There are many reasons why a particular college offers tuition discounts and incentives. Some of the obvious reasons are to:

- Attract better students

- Compete with public university prices

- Increase freshman class size (fill empty seats to increase enrollment, or to attract good students.

Understanding how and where to find those colleges that offer money inducements gives students an opportunity for a quality education while reducing their overall college costs.

Here’s How The Colleges Play The Game

When the college sets a sticker price for their tuition, higher income families naturally pay full tuition, while lower-income families are subsidized with financial aid. This is how the system has worked for years and colleges use this method to attract a more socio-economic group of students.

In reality, though not all higher income families pay full tuition and not all lower income families will be offered enough financial aid to get a deep discount on tuition.

Colleges actually put incoming freshmen into pools and set a range of tuition price based on those pools. In this example, each family is put into a pool based on the amount of income and assets they show on the FAFSA and/or PROFILE financial aid forms. Then the college uses a mathematical process called “financial aid leveraging” within each pool to attract and enroll the best students in their college while using the minimum amount of financial aid to do it.

In other words, they will take a $40,000 scholarship they normally give to a needy student in a lower tier pool and break it into four scholarships of $10,000 each for wealthier students in an upper tier pool. These wealthier students would probably go elsewhere without the financial incentive of a $10,000 tuition discount.

“Financial aid leveraging” is a game colleges play and they play it very well. And if you know how to play the game, you can avoid paying full price, even if you’re a millionaire. Why should you pay a higher price to subsidize other students?

How You Can Get Your Share Of College Tuition Discounts

Institutional aid is not guaranteed. Students wishing to be considered for institutional aid must position themselves correctly to be recruited by private colleges. Proper positioning begins early in high school and involves the following seven factors:

- Good Grades

- Good SAT/ACT test scores

- A solid resume of achievement

- Apply early in the academic year

- Apply to schools that recruit the same students

- Apply to schools that have a low yield factor

- Apply to 6-8 colleges

Good Grades

Good grades are self-explanatory. The presumption is that good grades in high school will mean good grades in college and ultimately graduating from college and becoming an alumnus. A student should have a minimum of a 3.0 GPA in high school to be in the running for a tuition discount.

SAT/ACT Test Scores

The SAT/ACT college prep test scores are merely qualifiers, but colleges have no other way to compare the academic abilities of a student from Ohio with a student from California. A student should have a minimum of 24 ACT or 1250 SAT test score to be in the running for institutional aid.

Solid Resume of Achievement

Throughout their high school years, students should build a solid resume of achievement and list any civic groups or community service projects that they were involved in. This will demonstrate to the colleges that the student is well rounded and is active in student affairs outside of normal studies. Treat this exactly the same as preparing a resume for a job! Send a resume with the application to each school.

Apply Early in the Academic Year

Apply to the various colleges early in the senior year of high school (September-December). The rule of thumb here is the earlier the better! Remember, once a particular school begins to fill the upcoming year’s freshman class, the need for a private college to offer institutional aid diminishes.

Apply to Schools that Recruit the Same Students

Private colleges compete with each other for the same students and are more likely to give significant institutional aid if they know the student is also applying to a competitive school.

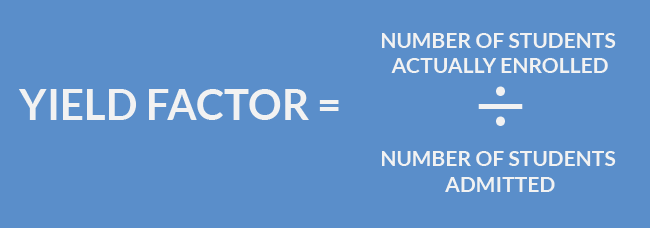

Apply to Schools that Have a Low Yield Factor

Look to apply to colleges that have a high amount of students that are admitted, but a lower number that actually enrolls. Enrollment is key to a college’s survival. Many colleges select students for admission to their school only to have them enroll and attend another. Private colleges have a constant battle to fill seats every year. The second tier private colleges are even more challenged because they must compete with the low cost of public universities and the popularity of the elite private (Ivy League) schools. As a result, the student to has a high probability to receive institutional aid from private colleges with a low enrollment yield percentage.

Apply to 6-8 Colleges

Students should apply to a minimum of 6-8 colleges. At least four should represent private colleges that compete with the student’s first choice college. Applying to several colleges gives the student the opportunity to receive institutional aid from one college and use that award to ask for a similar, or better, award from the college the student would prefer to attend.

It Pays To Hire A Certified College Funding Specialist

The bottom line is… there’s really two prices for college that families will pay.... a lower price for families that have a financial game plan and much higher price for those who do not.

Of course, we are biased, but financial professionals who are Certified College Funding Specialists (CCFS®), are the only hope families have to make sense of this crazy college system, and give them a fighting chance of not overpaying for college. To think the Federal government or the colleges will come up with a solution for high tuition costs is doubtful.

Posted by Ron Them

He is a former Chief Financial Officer of a Fortune 500 company and currently owns his own financial advisory company specializing in cash flow planning for business owners and executives. He developed the Cash Flow Recovery™ process that uses cash flow management principals to increase asset value and build wealth for business owners.

He is also the originator of several software calculators to help advisors and families make college affordable, including:

* College QuikPlan EFC Calculator

* "Find the Money" College Cash Flow Calculator

* College Debt Reduction Calculator

Ron has been quoted in U.S. News and World Report, Kiplinger's Personal Finance, Smart Money, Financial Advisor Magazine, Small Firm Profit Report, Practical Accountant, LIMRA's Market Facts, Senior Advisors Magazine, HR Magazine, BenefitNews.com, Employee Benefit News Magazine, ProducersWeb.com, Entrepreneur Magazine, Insurance Selling Magazine, CollegeNews.com, The Christian Voice, and Columbus CEO Magazine.