Rate of Return vs. Return on Investment - Selling Cash Value Life Insurance In A Rising Stock Market

I had a few really good conversations with advisors over the last few months about how to generate more clients. So, I thought it would be good to discuss a conversation I recently had a with a guy named George. He was an employee of a friend of mine. He was looking for ways to cut his daughter’s upcoming college costs.

She had just informed him that she wanted to attend a private college that would cost him about $50,000 a year. According to my friend, George is a smart guy that has done well in the market, but now he’s in the same spot where most college-bound parents end up - emotion vs. logic. Guess what? With kids, emotion wins over about 90% of the time.

When I was actively working with clients, I used to get a lot of guys like George, in love with the published rates of returns in advertisements of mutual funds and stocks. Most wanted to keep their current investments, but wanted to know if there were other ways that they could game the college financial aid system to lower costs.

My standard answer...

“Cash value life insurance is not counted as an asset in any financial aid formula, even at elite private colleges. And, as an added benefit, if something happens to either you or your wife, college is paid for with the death benefit. Even better, if you build up the policy quickly, you can borrow from your policy to pay the tuition costs; rather than borrow a bunch of college PLUS loans at a ridiculous rates over 11% (7% interest rate plus a 4.264% origination fee), just so you can keep all your money in that stock market you’re so giddy about.”

I am sure many of your reading this have had these types of prospects and clients. They seem to be addicted to the stock market when times are good. Even when I tell them that the ONLY thing guaranteed to go up 5%-7% every year is… college costs. How easy it is to forget about 10 years ago when the market lost half its value.

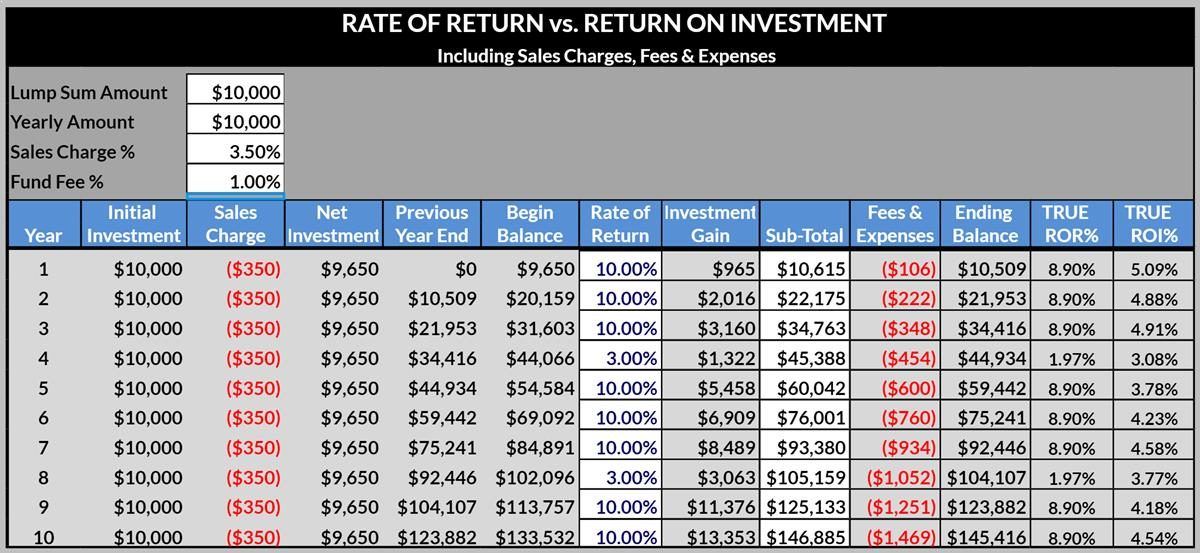

How did I quickly turn them around? I would explain Rate of Return vs Return on Investment using my Excel calculator.

Rate of Return vs Return on Investment Excel Calculator

Return on Investment is much different than Rate of Return. I wished all the Stock Market Analysts would get this right. Rate of Return is how much your investment goes up, year-to-year. Return on Investment is how much your investment is worth after a period of time. Big difference!

After all, the only thing you should really care about is how much money you end up with. Once commissions, admin expenses, and 12b-1 fees come out of your mutual fund investments, well, let’s just say that a high cash value life insurance policy doesn’t look so bad, especially after you consider all the intrinsic benefits that come with cash value life insurance - like college financial aid.

Now let’s get back to George and his need to cut college costs. I needed to get past his love affair with the stock market, or he would for sure take out PLUS loans with 7% interest rates plus 4.264% origination fees, and that would take his stock market returns down. So I took out my trusty Return on Investment calculator and here’s his response to my sample case:

Me: “George, let’s assume a simple investment. Let’s put in $10,000 a year into mutual funds for 10 years, or $100,000. And let’s assume you earn 10% every year on these funds over that 10 year period. Now let’s assume the lowest possible commissions of 3.5% and expenses of 1%. These costs are low for a small investment of only $10,000, but let’s use this for now. "

George: "Ok."

Me: As you can see, because the 'Rate of Return' (ROR) is calculated for each individual year after these low commissions and expenses are deducted, your ROR is 8.9% after each year, right?

George: Yes.

Me: But your Return on Investment (ROI), or the net amount you actually end up with at the end of that 10 year period, is a much lower at only $158,900 because you paid a total of $3,500 in commissions and $7,712 in fees and expenses over that 10 year period. After 10 years, that's only a 5.89% ROI. But that’s what’s important right, not your rate of return, but how much you actually end up within 10 years, right?

George: I never thought of it that way, but you’re right.

Me: Ok, now let’s see what happens if your earned 10% every year for eight years, but in two of those ten years, say the third year and the ninth year, the market return was only 3%. Not bad market returns like the one in 2008, but just blah market returns of 3%.

George: Ok

Me: Now your Return on Investment is only 4.57% over that 10 year period, and the amount you end up within your account is only $145, 732 after ten years.

George: Yes, both investment costs and lower stock market returns make my investments average, not outstanding. I can see that.

Me: Ok, but again, it’s not like 2008 where everybody got killed. In this case, you still made money. Just not as much as you thought. So you see, when you take into account commissions and expenses and a couple of years of blah stock market returns, it sure puts cash value life insurance in a better light, right? In addition, you also get life insurance to protect your daughter’s education, and you can borrow from your cash value to pay student loans.

George: Ok.

Me: But wait, I'm not done. What if I can also get you $10,000 a year for four years in financial aid to cut your upcoming college tuition costs, that would be icing on the cake, right? It's $40,000 you don't have to spend. Or look at it this way, it would be the same as having an additional $40,000 in your mutual fund account, right? How much would that increase your return?

George: Ok, now I get it. I'm interested. Can you run the numbers and do a comparison for me to see exactly where I'd stand?

And that my friends is a great (if not the best) way to sell cash value life insurance in a rising stock market. In a crazy market, people forget the past - and it seems as though they never recognize the costs of investing each year.