How to Use a 1040 With Your College Funding Clients to Sell Life Insurance

Since the majority of time and effort for any financial advisor goes into prospecting for new business, you should always strive to make the most profit from each contact. This means you will need to make each prospect as comfortable as possible when discussing their finances. You will also need an array of ideas and strategies that will keep your prospect’s interest, and then determine when a financial product will fit that strategy.

Cash value life insurance is not the easiest financial product to sell, but for advisors in the college funding market, the IRS 1040 tax return can provide an easy way to begin that discussion with prospects. The ability to defer income and shelter assets into cash value life insurance is a major financial strategy in both saving and paying for college.

The fact that cash value life insurance is exempt from the financial aid formula (for both the FAFSA and the CSS PROFILE) is also a major plus. In the college financial aid world, income is assessed at 47%, and significant asset balances are assessed at 5.64%. As a result, sheltering both income and assets into a cash value life insurance policy has allowed many families to receive significant financial aid and dramatically cut their cost of college.

Your client’s and prospect’s latest tax return will give you a general perspective of their financial position; but to do a thorough analysis, you should obtain the last three year’s of a prospect’s tax returns. The information below is designed as a general overview of potential ideas and strategies and is not intended to provide specific legal or tax advice. Please encourage your clients to seek advice from a tax advisor, if they do not already have one.

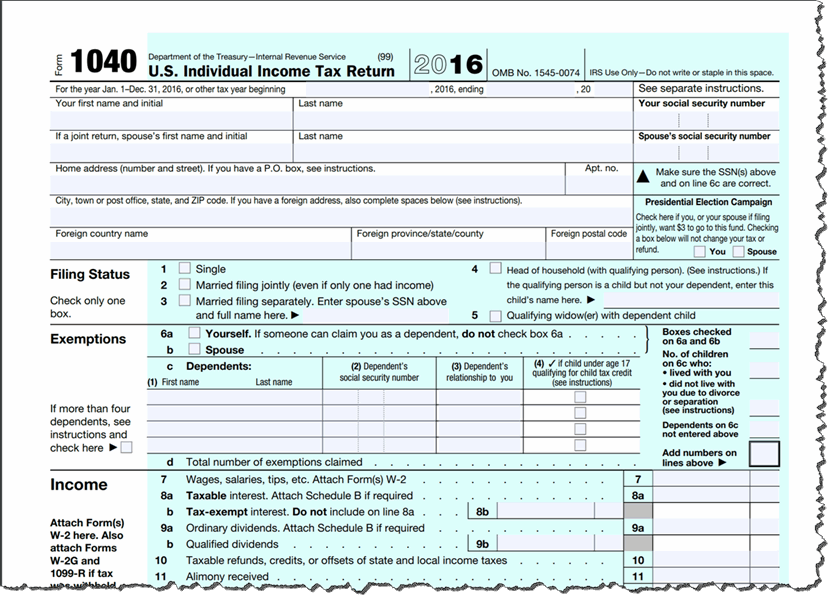

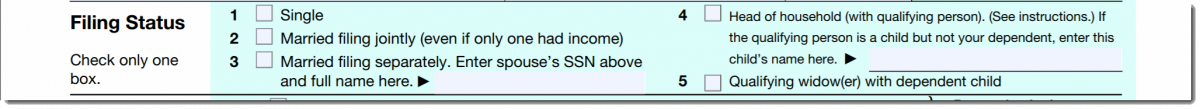

Filing Status (Schedule 1040, Lines 1–5)

What to Look For:

What to Look For:

The marital status of a client or prospect is essential to strategic financial aid planning. Check to see if there's been a change in the client's filing status over the last three tax returns. This can indicate a recent marriage, divorce or death of a spouse (widowed). Any of these life changes can open the door to potential issues related to college financial aid, insurance, and retirement planning.

Questions to Ask:

If Client is Recently Married

- If you were recently married and had children from either marriage that will soon attend college, your new spouse’s income must be included in their income when filing the FAFSA and PROFILE financial aid forms. Have you thought about deferring part of your income and sheltering any assets to better prepare yourself for the cost of college and your ability to qualify for financial aid?

- Have you thought about purchasing additional life insurance, or disability insurance for you and/or your spouse to cover future education costs?

If Client is Divorced/Separated

- If you are divorced/separated and have children that are living with you that will soon attend college, your ex-spouse’s income will not be included in your income when filing the FAFSA financial aid forms. This will indeed help when qualifying for financial aid, but have you reviewed and updated the beneficiary designations on any life insurance policies, qualified retirement plans, IRAs and other financial assets since your divorce/separation? This is needed to protect the children’s education.

- Did your divorce settlement require you and your ex-spouse to maintain life insurance on each other? If life insurance wasn’t specified in your settlement, should you consider purchasing life insurance on your ex-spouse, should they die prematurely and leave you without income?

- Is there an education clause in your divorce decree for the children? If not, should you consider purchasing life insurance on your ex-spouse, so the children’s education is guaranteed?

- If you are employed, have you reviewed and updated the beneficiary designations on your 401(k), IRAs and other employer-sponsored retirement plans?

- Now that you’re single, have you thought about purchasing disability insurance should you become unable to work?

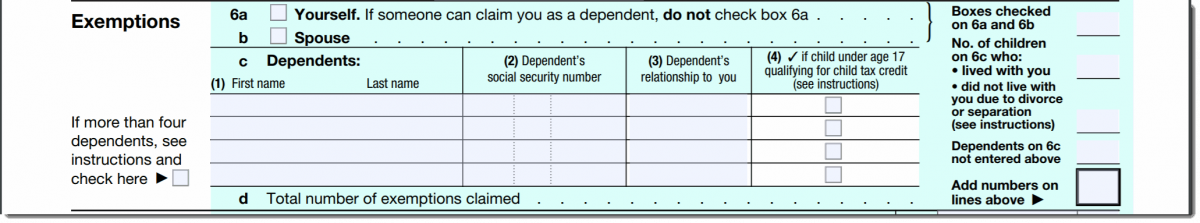

Dependents/Exemptions (Schedule 1040, Line 6)

What to Look For:

This dependents line reveals whether or not your prospect has dependents they're responsible for; such as the spouse, children, grandchildren, dependents with special needs, and elderly dependents like parents and grandparents. This gives you the opportunity to ask if they have children in college, or children planning to attend college soon. It also provides an opportunity to discuss strategies for college education planning, cash value life insurance, and disability income insurance.

Questions to Ask:

- Do you have children in college, or do you plan to have children attending college soon?

- Have you reviewed and updated beneficiaries on your life insurance to include the youngest children in your family?

- Do you and/or your spouse have disability insurance to cover your family’s college expenses should either of you become disabled?

- Do you have enough life insurance to cover your dependents’ needs, such as college, mortgage, etc. if one of you unexpectedly passed away?

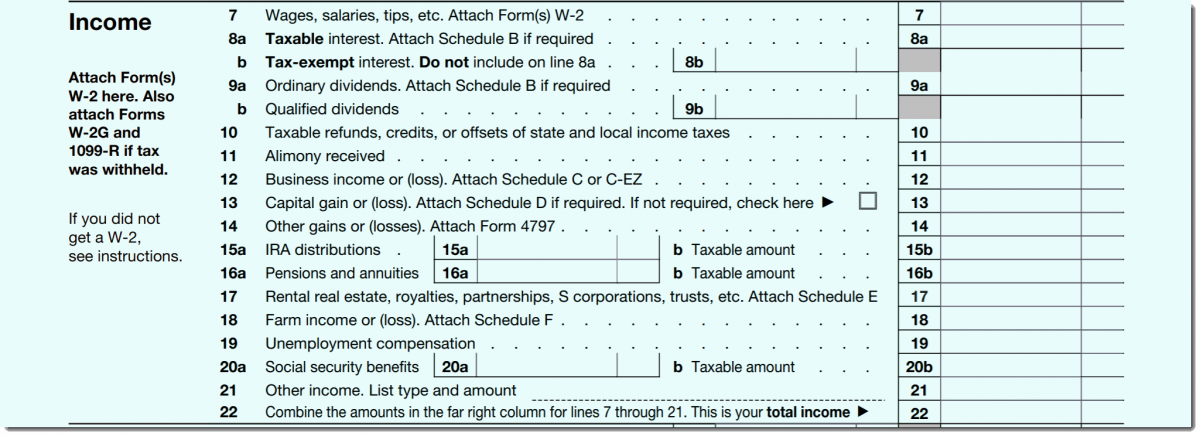

Income Section of the 1040

Wages and Salary (Schedule 1040, Line 7)

What to Look For:

IRS 1040, Line 7 indicates the prospect’s income over the last three years and potential college financial aid. When considering whether or not a family qualifies for college financial aid, the particular college that the student plans to attend and the income the family earns are the two biggest factors. Since cash value life insurance is exempt from the financial aid formula for both the FAFSA and the CSS PROFILE, deferring income and sheltering assets into cash value life insurance is a major financial strategy in the college funding field. This approach won’t work for many families, again due to the particular college that the student plans to attend and the income the family earns; however, it has allowed many families to receive the financial aid they needed to attend the college of their dream.

Questions to Ask:

- Have you considered the income shelter and tax-deferral opportunities provided by cash-value life insurance products?

- If you or your spouse dies or becomes disabled, will there be enough money to support your family, pay off your mortgage, and pay for college expenses?

Taxable Interest (Schedule 1040, Line 8a) and Tax-Exempt Interest (Line 8b) plus Ordinary Dividends (Schedule 1040, Line 9a) and Qualified Dividends (Line 9b)

What to Look For:

Lines 8a, 8b, 9a, and 9b are one of the first places a college financial aid officer (FAO) will look on the IRS 1040 when qualifying a family for financial aid. Line 8a will show the Financial Aid Officer the amount of liquid assets a prospect has in Savings Accounts, Money Markets, Certificate of Deposits, and Taxable Bonds. Whereas, IRS 1040 Line 8b shows current tax-exempt interest received from Municipal Bonds and Municipal Bond Funds. Lines 9a and 9b show current dividends received from stocks or mutual funds. Depending on the college(s) the children plan to attend, these four lines can provide an opportunity to discuss how to utilize cash value life insurance as part of their financial aid and income and asset shelter strategy.

For instance:

Line 8a – Is taxable interest high? More than $5,000? Currently, taxable interest from CDs and money markets is around 1.25%, so if you see $5,000 taxable interest, you know right away they have at least $400,000 sitting in low-yielding taxable accounts. However, you do not need to guess. Go to Schedule B, and it’s all right there. It lists all the of interest they get. Making it easy to determine how much is invested in each asset by estimating the yield and dividing that number into the amount you see on Schedule B ($5,000/.0125 = $400,000).

Line 8b – Do they or should they have tax-exempt income? Go to page 2 and check out line 39 "taxable income," and determine if they are in a high tax bracket and have a need to be investing for tax-free income. Reference their income on the tax rate schedule. Below 20%, then they should NOT own tax-free securities. If their tax bracket is high, they may be better off investing in cash value life insurance.

Line 9a – Lots of dividends? Probably means they are heavily weighted in stocks or mutual funds, and you have an opportunity to get third-party reports from Morningstar or Value Line to show them how their investments are really doing. Flip to Schedule B. Do you see large-cap stocks? You should know that large-cap stocks have dividends less than 2%, so $41,200 of dividends shows they own about $2 million of stock.

In either of these cases, these assets must be reported on the FAFSA and PROFILE financial aid forms so that the college financial aid officers will see it, and possibly lower the amount of college financial aid the family will receive. Remind the family that growth in cash value life insurance is tax-deferred, and does not show up on the IRS 1040, or the FAFSA or PROFILE

Questions to Ask:

- Did you know that any asset that shows up on Schedule B will lower the financial aid that you're eligible to receive? Have you ever considered shifting some of your money into tax-deferred cash-value life insurance products that are not only exempt from financial aid assessment but also capable of providing a tax-free cash flow to pay college expenses?

- Would you be interested in learning how cash-value life insurance can not only insure that your children can complete their education but properly structured can also also be used to lower your total education cost and pay off any outstanding student loans at graduation?

Alimony Received (Schedule 1040, Line 11)

What to Look For:

Determine if the amount of alimony received is a considerable source of income. If so, it will need to be included in the children’s education strategy.

Questions to Ask:

- Did your divorce settlement require you and your ex-spouse to maintain life insurance on each other? If life insurance wasn’t specified in your divorce agreement, should you consider purchasing life insurance on your ex-spouse should they die prematurely and leave you without income?

- Is there an education clause in your divorce decree for the children? If not, should you consider purchasing life insurance on your ex-spouse, so the children’s education is guaranteed?

- If you are employed, have you reviewed and updated the beneficiary designations on your 401(k), IRAs and other employer-sponsored retirement plans?

Business Income or Loss (Schedule 1040, Line 12 and Schedule C)

What to Look For:

Businesses that have less than 100 employees are not assessed on the FAFSA financial aid form, but they are closely looked at on the CSS PROFILE form. For small business owners, all Schedule C income earned goes directly to the IRS 1040 and is assessed at 47%. Cash value life insurance can not only help protect their family and lower their tax burden, but it can also provide a cash-value build up that will not show up on the financial aid forms during college years and can be borrowed free of income taxes to pay off loans after graduation.

Questions to Ask:

- Have you considered the tax-deferral opportunities provided by cash-value life insurance products, such as keeping part of your income off the financial aid forms while your children attend college?

- If your child attends an elite private college, the college will look closely at your business income and assets on the CSS PROFILE form. Have you considered how cash value life insurance cannot only guarantee your children’s education and lower your tax burden, but it can also provide a cash-value build up that will not show up on the financial aid forms during college years, and can then be borrowed free of income taxes to pay off loans after graduation.

- If you become disabled, will you have enough income to support your family, run your business, and educate your children?

- Do you have enough insurance to pay off your mortgage, and insure that your children are educated if you passed away?

Capital Gains and Losses (Schedule 1040, Line 13)

What to Look For:

Entries on Line 13 (Schedule D) are indicative of monies in an investment portfolio. Were there unusually large capital gains? Did they sell assets and now have money sitting around in a passive account? Do these prospects appear to be aggressive investors? The bottom line is capital gains (like interest and dividends) means there are assets that create income. Since assets are assessed at 5.6% and income at 47% on the college financial aid forms, clients attending private colleges should consider a financial game plan using cash value life insurance. They can also use it to serve as a more conservative part of their portfolio.

Questions to Ask:

- Did you know that any asset that shows up on Schedule D will lower the financial aid that you're eligible to receive? Have you considered moving some of your savings into tax-deferred cash-value life insurance products that are exempt from financial aid assessment?

- Would you be interested in learning how cash-value life insurance can not only insure that your children can complete their education but properly structured can also be used to lower your total education cost and pay off any outstanding student loans at graduation?

IRA and Pension Distributions (Schedule 1040, Lines 15–16)

What to Look For:

Distributions from an IRA are reported on IRS 1040 line 15a, and the taxable amount of those distributions is on line 15b. Distributions from pensions and annuities are reported on line 16a and the taxable amount of these distributions is on line 16b. You are not likely to see these distributions on a family's IRS 1040 forms during college years, except for three reasons:

- Line 15 - the family took a distribution from their IRA in order to pay college costs, or

- Line 16 - the family took a distribution from their pension in order to pay college costs, orLine 16 - the family received the proceeds of an annuity from a will or trust, due to the death of a family member (or acquaintance).

- Line 16 - the family received the proceeds of an annuity from a will or trust, due to the death of a family member (or acquaintance).

Distributions from an IRA or pension are treated harshly for college financial aid purposes. The net asset distribution (Line 15a minus 15b & Line 16a minus 16b) is not treated as an asset (which it is), but as “Untaxed Income” and assessed as income at 47%, not as an asset at 5.64%.

For this reason, even if the prospect does not show a distribution in Line 15 or Line 16, you should ask the college family if there are any plans to take a distribution for college expenses, then discuss the potential of moving at least part of their current contributions to IRAs and/or pension plans to a cash value life insurance product. This way, the cash value asset stays off the financial aid forms and the income can be distributed by borrowing from the policy.

You should also ask who owns that account and what happens when they pass away. If the pension stops at death, you have the opportunity to sell a life insurance policy to replace that income for the surviving spouse.

Questions to Ask:

- Are there are any plans to take a distribution? If so, distributions are treated harshly for college financial aid purposes. To get a better result, you may want to consider moving at least part of your current contributions to IRAs and/or pension plans to a cash value life insurance product. This way, the cash value asset stays off the financial aid forms and the and income can be distributed by borrowing from the policy.

- Who owns the pension account on Line 16? What happens when you pass away? Does the pension stop at death?

Rental Real Estate, Royalties, Partnerships, S Corporations, and Trusts (Schedule 1040, Line 17 and Schedule E)

What to Look For:

If Line 17 and Schedule E indicate business interests, then similar to Line 12, businesses under 100 employees are not assessed on the FAFSA financial aid form, but they are closely looked at on the CSS PROFILE form. For small business owners, all income earned goes directly to the IRS 1040 Schedule E and is assessed at 47%. In this case, cash value life insurance can not only help protect their family and lower their tax burden, but it can also provide a cash-value build up that will not show up on the financial aid forms during college years, nd can be borrowed free of income taxes to pay off loans after graduation.

If the prospect has partners in their business, explain how life insurance can be used to fund a buy-sell agreement that immediately pays survivors for their share of the business. Let them know how various insurance products can provide capital to help the business keep going should a partner, owner, or key employee, suddenly die or become disabled.

If Line 17 and Schedule E represent rental real estate holdings, are there any plans to sell the property soon to free up cash (college expense)? If so, this cash can be used to purchase a cash value life insurance policy and not only guarantee your children’s education and lower your tax burden, but it can also provide a cash-value build up that will not show up on the financial aid forms during college years, and can then be borrowed income tax-free to pay off loans after graduation.

Questions to Ask:

- Have you considered the tax-deferral opportunities provided by cash-value life insurance products, such as keeping part of your income off the financial aid forms while your children attend college?

- If your child attends an elite private college, the college will closely look at your business income and assets on the CSS PROFILE form. Have you considered how permanent life insurance cannot only guarantee your children’s education and lower your tax burden, but it can also provide a cash-value build up that will not show up on the financial aid forms during college years, and can then be borrowed income tax-free to pay off loans after graduation.

- Do you have partners in your business? Do you have a buy-sell agreement in case one of your partners die? Did you know that life insurance can be used to fund a buy-sell agreement that immediately pays survivors for their share of the business?

- Are there any plans to sell the property soon to free up cash (college expenses)? If so, do you know that this cash can be used to purchase a cash value life insurance policy and not only guarantee your children’s education and lower your tax burden, but it can also provide a cash-value build up that will not show up on the financial aid forms during college years, and can then be borrowed income tax-free to pay off loans after graduation.

- Do you have sufficient property and casualty insurance on your rental property?

- If you become disabled, will you have enough income to support your family and run your business, and educate your children?

- Do you have insurance that could pay off your mortgage if you passed away?

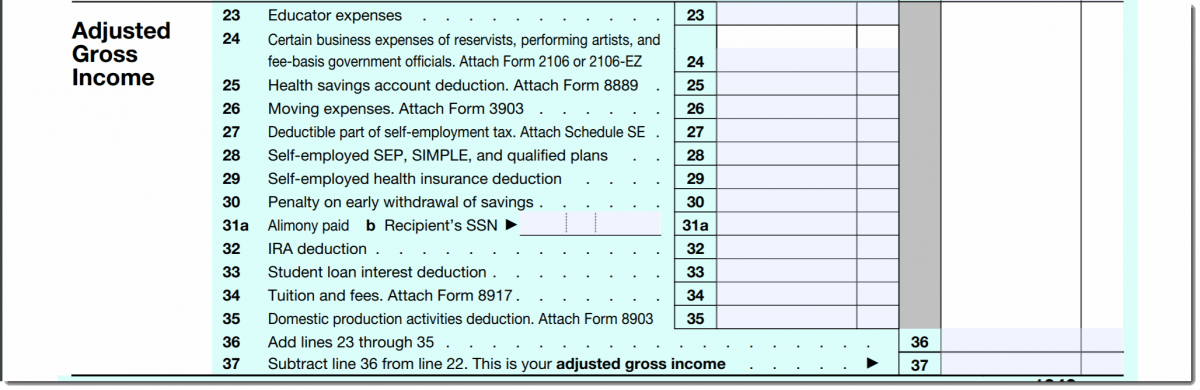

AGI (Lines 23-37)

- Moving Expenses (Schedule 1040, Line 26) and Schedule A

- IRA Deduction (Schedule 1040, Line 32)

- Student Loan Interest Deduction (Schedule 1040, Line 33)

Moving Expenses (Schedule 1040, Line 26) and Schedule A

What to Look For:

Line 26 determines that the client had a recent move and change of address.

Questions to Ask:

- Will this recent move affect your children's college education aspirations in any way?

- From a cost standpoint, do you now live closer to the college(s) that your student plans to attend?

- Do you currently live in a state that is income tax-free? What do you plan to do with that excess cash flow?

- Is your new home properly insured for property and casualty?

- Do you currently have enough life insurance to pay off any mortgage debt should something happen to the main breadwinner?

- Did you have any excess proceeds from the sale of your last residence? If so, how did you invest those proceeds?

IRA Deduction (Schedule 1040, Line 32)

What to Look For:

If there's a deduction listed on Line 32, this dollar amount must be added back as “untaxed income” on line 93b. of the FAFSA form.

Questions to Ask:

- Did you know that this deduction is added back into the financial aid formula as untaxed income? It dramatically reduces the amount of financial aid you qualify for. Would you like to hear about how cash value life insurance can benefit you in this case?

- Have you reviewed and updated beneficiary designations on your IRA?

- Are you happy with your IRA investment allocations?

Student Loan Interest Deduction (Schedule 1040, Line 33)

What to Look For:

This line item indicates that the student is currently in college, or has graduated and that the student and/or parents are currently making payments on loans borrowed for education. The potential here is to switch to a lower loan payment plan and extend the years, then use the extra cash flow from your original payment to fund a cash value life insurance policy. This strategy could potentially pay the note off about 5 years early.

Questions to Ask:

- Is this deduction for Stafford loans (student) or PLUS loans (Parent)? If for the student, are they currently in school or graduated?

- Have you researched alternative payment plans to lower your payment and put the balance of your payment in a cash value life insurance policy?

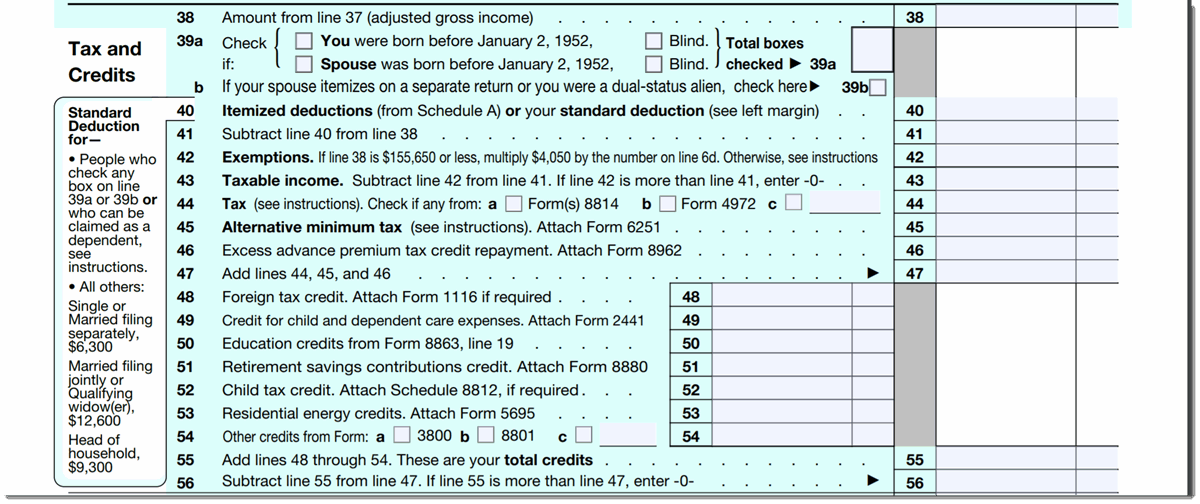

Itemized Deductions (Schedule 1040, Line 40 and Schedule A)

What to Look For:

This is the area of the IRS 1040 where prospects show the total of their itemized or standard deductions. If itemized, then they also list their deductions on Schedule A. If the prospect has a Schedule A attached to their IRS 1040, look at the following items:

Line 6 - Real Estate Taxes. This size of this number, plus the zip code from the address, can give you some insight as to the size of their primary residence and even income range to market college funding.

Line 10 - Home Mortgage Interest. This number should grow smaller and smaller the older the client is and gets closer to retirement. A smaller the number can tell you that a client is in a smaller house, and/or and good at planning for retirement. A larger number may warn you that the client may be living beyond their means, and if they have children that are college age, will have difficulty paying for college and may end up being student loan poor. Many families in the USA are in that category.

Lines 16-18 - Gifts to Charity. You can deduct contributions or gifts you gave to organizations that are religious, charitable, educational, scientific, or literary in purpose. If you see significant gifts (e.g. more than 2% of income) this may indicate some interest in charitable gifting giving rise to a discussion about converting their donations into life insurance that would pay a considerably larger gift to their favorite charity upon their death.

Questions to Ask:

- Did you know you can purchase a life insurance policy, listing your charity as beneficiary, then borrow from the policy tax free for college expenses, and then forward the balance to the charity at your death?

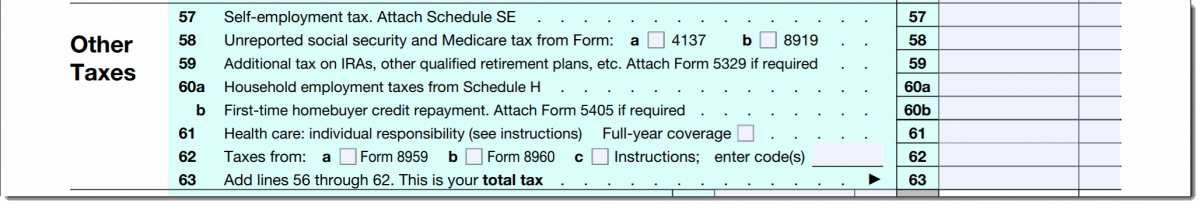

Federal Income Tax Withheld and Refund (Schedule 1040, Lines 61 and 72)

What to Look For:

A sizable refund can reveal that a client is withholding too much federal income taxes during the year. You may want to point out that their refund is like a year-long loan they've made to the Federal Government, tax and interest-free. Merely adjusting their withholding tax can increase cash flow that can be used for college expenses, or a cash value life insurance policy. for tax-deferred annuities and other insurance products.

Questions to Ask:

- Mr. Smith, a large tax refund like this sticks out like a sore thumb to a college financial aid officer. They consider this an extra resource and will deduct 100% of it from any financial aid that you receive. Have you talked to your CPA (or payroll manager at your company) about adjusting your withholding to eliminate this large dollar refund and spread it out over the year? This will also create extra cash flow each month in your paycheck that you can use to pay college expenses, or dump into a cash value life insurance policy and pay college expenses from there.

Additional Questions To Ask About Tax-Deferred Items On The IRS 1040 Tax Return

- Do you have any IRAs that you’re not receiving distributions from?

- Do you have any old 401(k) plans that haven’t been rolled into an IRA?

- Do you have any existing 401(k) that you’re still contributing to?

Posted by Ron Them

He is a former Chief Financial Officer of a Fortune 500 company and currently owns his own financial advisory company specializing in cash flow planning for business owners and executives. He developed the Cash Flow Recovery™ process that uses cash flow management principals to increase asset value and build wealth for business owners.

He is also the originator of several software calculators to help advisors and families make college affordable, including:

* College QuikPlan EFC Calculator

* "Find the Money" College Cash Flow Calculator

* College Debt Reduction Calculator

Ron has been quoted in U.S. News and World Report, Kiplinger's Personal Finance, Smart Money, Financial Advisor Magazine, Small Firm Profit Report, Practical Accountant, LIMRA's Market Facts, Senior Advisors Magazine, HR Magazine, BenefitNews.com, Employee Benefit News Magazine, ProducersWeb.com, Entrepreneur Magazine, Insurance Selling Magazine, CollegeNews.com, The Christian Voice, and Columbus CEO Magazine.