HOW A 30-YEAR-OLD RESIDENT DOCTOR USED CASH VALUE LIFE INSURANCE TO WIPE OUT $120,000 IN STUDENT LOAN DEBT AND CREATED A $2,000,000 PRIVATE TAX-FREE WEALTH FUND FOR RETIREMENT.

Last month I presented a unique case study (Jack & Diane) using Parent PLUS loans and a couple of loopholes in the Federal Loan Forgiveness programs to cut the cost of the client's children’s college education in half, and put those savings back into their retirement.

In this article I’m going to demonstrate how financial advisors like you, can use two unique loopholes to attract and retain young High Earners, Not Rich Yet (HENRYs) like doctors, dentists, veterinarians, pharmacists, and attorneys.

The two loopholes are:

- An Income-Driven Repayment (IDR) strategy that qualifies student loan borrowers for Federal loan forgiveness, and

- The ability to borrow from a cash value life insurance policy and use that money for a tax-free retirement.

These young HENRYs usually carry large student loan balances which many times can cause them to postpone getting married, starting a family, buying a home, taking vacations, or maximizing their retirement. Advisors that know how to use these two loopholes will gain a tremendous in-road to capture and retain these future millionaires as long-term clients.

CASE STUDY - HOW EDWARD, A 30-YEAR-OLD RESIDENT DOCTOR, USED CASH VALUE LIFE INSURANCE AND A STUDENT LOAN FORGIVENESS STRATEGY TO WIPE OUT $120,000 IN DEBT AND CREATED A $2,000,000 PRIVATE TAX-FREE WEALTH FUND FOR HIS RETIREMENT.

Edward is a late bloomer and did not start his college education until age 22 when most students have already graduated from college. As a result, he’s now a 30-year-old graduate from medical school about to enter his residency. His starting income is $60,000 a year during his 4-year residency and then he will earn about $150,000 as a general practitioner when he moves back home and works for the rural hospital in his community.

However, Edward funded his college education using student loans and now he must begin to pay back his $250,000 student loan debt. His loan servicer, Nelnet, offered Edward the standard 10-year ($2,700 a month) repayment plan. Edward realized that it would be difficult to buy a new house and pay his modest living expenses if he has to also pay $2,700 a month for his student loans on his starting residency salary of $60,000, so he contacted a Certified College Funding Specialist to help him devise a game plan.

His Certified College Funding Specialist began the planning process by reviewing Edward’s entire student loan package. She noticed that the servicer did not even attempt to explain the other available low-cost income-driven repayment options to Edward. Unfortunately, this is a standard operating procedure for Federal Student Loan Servicers. Why?

- The lower cost Income-Driven Repayment (IDR) plans are complicated and require a considerable amount of time updating income, and changing plans based on rising income, marriage, kids, etc.

- Federal Loan Servicers earn little money for the time and effort they spend guiding student loan borrowers through these new, complicated Income-Driven Repayment plans.

Edward’s Certified College Funding Specialist calculated that Edward would net about $4,000 a month after taxes on his $60,000 residency salary. So the first step was to pick the right Income-Driven Repayment plan to reduce Edward’s loan costs so that he could cover his increased living expenses without borrowing more money and investing some of his savings.

STEP 1: PICKING THE RIGHT INCOME-DRIVEN REPAYMENT PLAN

To qualify for one of the five Income-Driven Repayment (IDR) plans, Edward must first combine all his different loans into one using a Direct Consolidation Loan. After consolidating his loans, Edward could then qualify for the PAYE Income-Driven Repayment plan to pay off his student loans. Why the PAYE IDR plan?

- The PAYE repayment plan has the smallest monthly payment (10% of his discretionary income)

- The PAYE repayment plan has the shortest payment period (20 years)

- If Edward gets married he can eliminate his wife’s income from the PAYE monthly payment calculation by filing his taxes as Married Filing Separate

- As Edward’s income rises his monthly payment will also rise, but only up to the original maximum standard 10-year repayment plan of $2,700 a month.

Using the PAYE repayment plan allows Edward to reduce his payment from the original standard 10-year plan of $2,700 a month to only $330 a month, for a total monthly savings of $2,370 during the first four years of his residency:

$60,000 (Annual Salary)

-

-

- $20,385 (150% of Poverty Level Guidline)

-

= $39,615

= $3,962 (x 10% factor)

= $330/month (/12 months)

This leaves Edward with $3,670 a month ($4,000 a month net salary - $330 a month loan payment) in cash flow for each year of his 4-year residency. Edward and his Certified College Funding Specialist decide to save $1,500 a month ($18,000 per year) of the $3,670 a month, leaving him a $2,170 a month to cover his living expenses.

Of course, as soon as Edward advances from his residency program to become a general practitioner, his income will increase to $150,000 per year and his monthly student loan payment will then increase each year up to $1,080 a month under the PAYE repayment plan.

STEP 2: PICKING THE RIGHT SAVINGS PLAN

The first priority in Edward’s investment planning process is to address the loan forgiveness on the PAYE student loan repayment plan that will occur in 20 years when he turns 50 years old. By paying only $330 a month for the first 4 years and gradually increasing to $1,080 a month (based on his increasing salary) in 20 years, Edward will end up with loan forgiveness of about $120,000 (almost 50% of his total education loans). This will create a tax bill (1099-C) from the IRS to Edward of $50,400 ( $120,000 loan forgiveness at a 35% federal + a 7% state tax rate) .

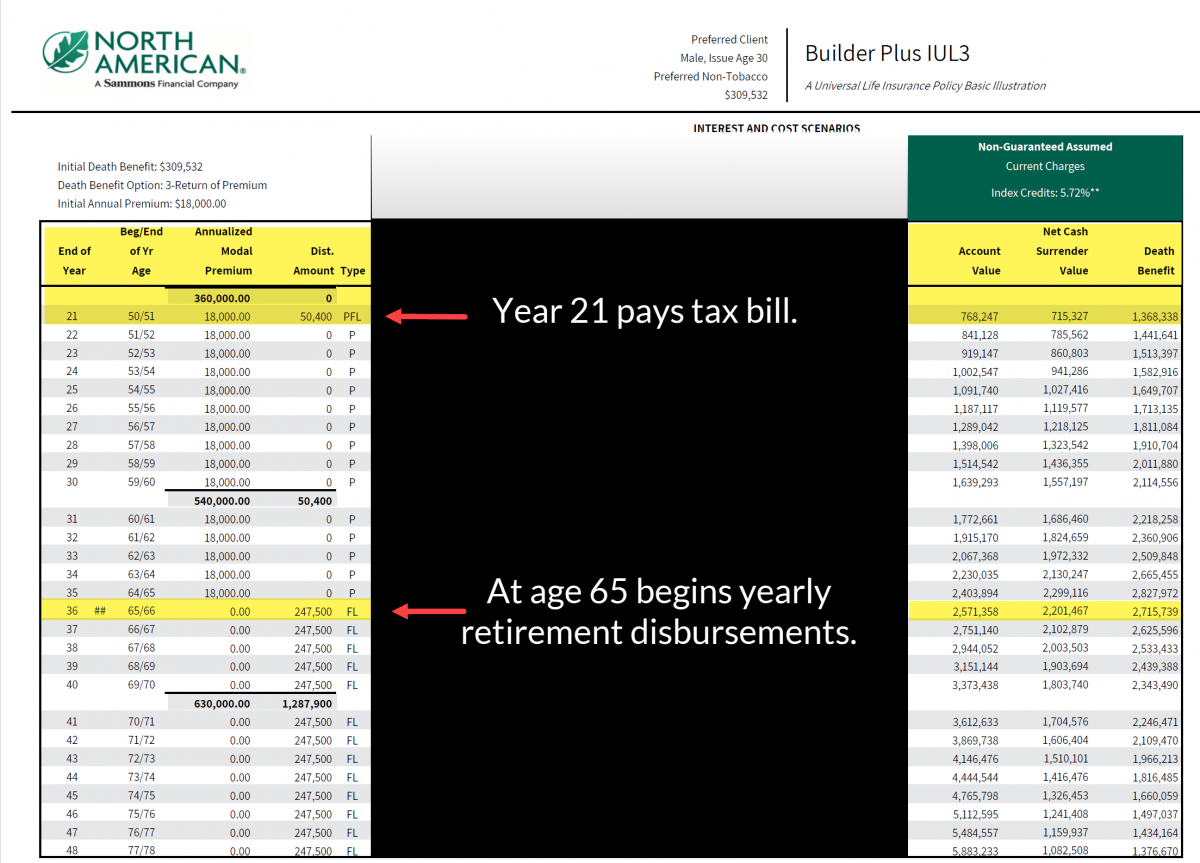

When the IRS comes knocking in 20 years, Edward and his Certified College Funding Specialist wanted to be sure the money was guaranteed to be there and not subject to the ups and downs of the stock market, like a 401k or 403b. So they decided to put the $1,500 a month savings into a cash value IUL policy. The reason they used an IUL cash value life insurance policy is for the safety and complete control of the money. The particular North American IUL life insurance policy used was specially designed to be overfunded. This is to keep the cost of the life insurance at a minimum and the cash value build-up at a maximum. Over those 20 years (age 30 to 50) the cash value grows in the IUL policy to $700,084.

After Edward pays his tax bill of $50,400, he will have $715,327 remaining in cash value (due to the annual premium and about 6% growth in the policy). Edward will now be age 50 and since he is not sure about any other contributions to another retirement plan, he plans to continue funding $18,000 per year into his North American IUL policy until age 65, when he plans to retire. At that time, Edward will have almost $2.3 million in cash value and plans to borrow $247,500 per year tax-free from the policy until age 85.

CONCLUSION

So what's the bottom line? In a nutshell, Edward only paid about $130,000 for his 8-year medical degree. He had $120,000 of his $250,000 in student loans forgiven, and even though he will owe an estimated tax bill to the IRS of $50,400 after 20 years for those canceled loans, he still will have enough money ($715, 327) in his cash value IUL policy to live comfortably into retirement.

However, by continuing to fund his policy each year until he is 65, Edward will have twice the spending power in retirement than he had during his working years. Even better, if Edward lives past age 85, he will still have $922,408 in cash value he can borrow from his policy and a death benefit to his heirs of at least $1,471,185.

If you're interested in learning more about strategies like this or want help implementing more advanced college funding concepts, I encourage you to become a Certified College Funding Specialist. We can teach you how to market college funding concepts to middle and upper-income prospects and use these same principles to create a comfortable retirement for clients.

Posted by Ron Them

He is a former Chief Financial Officer of a Fortune 500 company and currently owns his own financial advisory company specializing in cash flow planning for business owners and executives. He developed the Cash Flow Recovery™ process that uses cash flow management principals to increase asset value and build wealth for business owners.

He is also the originator of several software calculators to help advisors and families make college affordable, including:

* College QuikPlan EFC Calculator

* "Find the Money" College Cash Flow Calculator

* College Debt Reduction Calculator

Ron has been quoted in U.S. News and World Report, Kiplinger's Personal Finance, Smart Money, Financial Advisor Magazine, Small Firm Profit Report, Practical Accountant, LIMRA's Market Facts, Senior Advisors Magazine, HR Magazine, BenefitNews.com, Employee Benefit News Magazine, ProducersWeb.com, Entrepreneur Magazine, Insurance Selling Magazine, CollegeNews.com, The Christian Voice, and Columbus CEO Magazine.