EXPOSED: LATEST ENDOWMENT DATA REVEALS THE FINANCES OF SO-CALLED "NON-PROFIT" COLLEGES AND WHY THEY NEED TO STOP RAISING PRICES

One of my favorite things to do is to analyze financial data. I have been doing it since college. I know that sounds weird and geekish, but many times I discover unique data that others never or rarely cover.

In this case, it’s college endowments. The National Association of College and University Business Officers (NACUBO) recently issued its annual report, regarding the current state of college endowments. So let me give you some statistics on these so-called “non-profit” money making machines called… colleges.

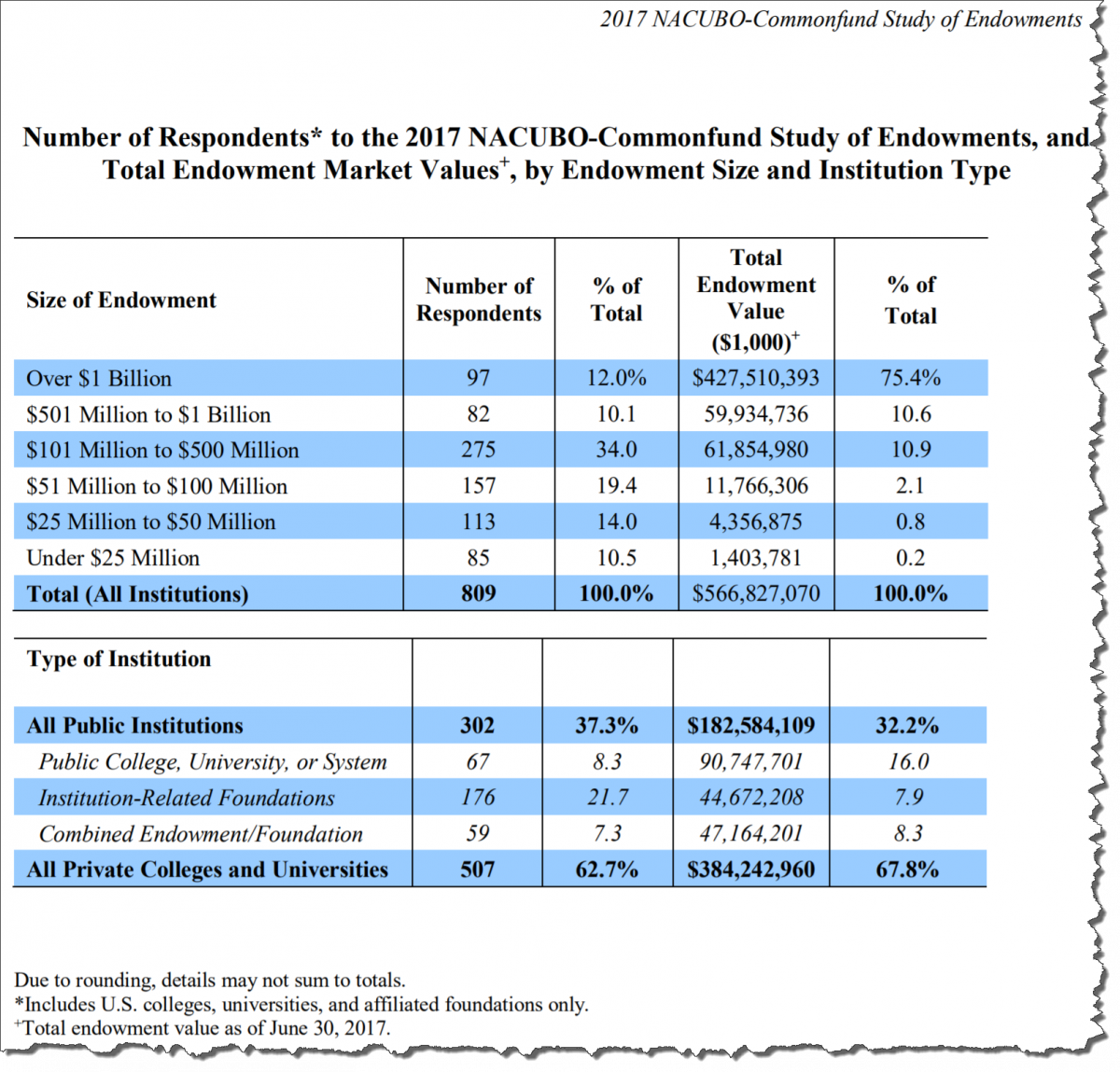

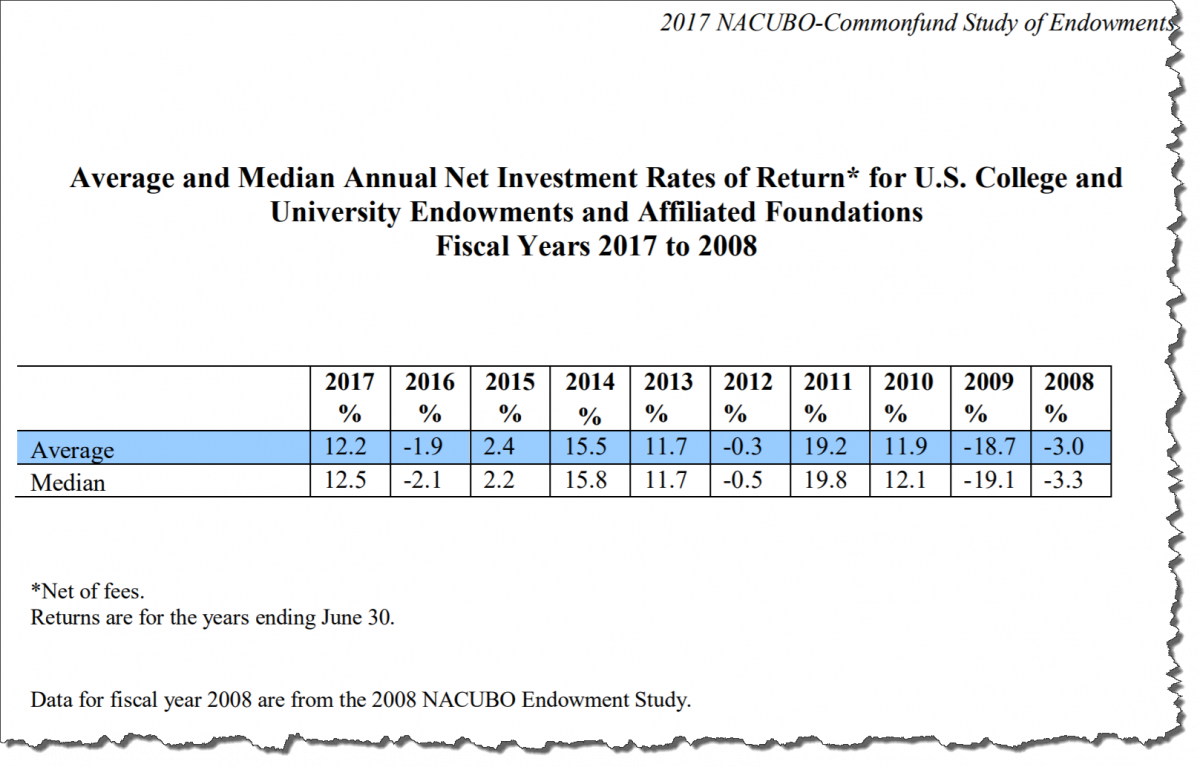

NACUBO gathered endowment (the college’s investment accounts) data from 809 U.S. colleges and universities and found that these institutions’ endowments returned an average of 12.2% for the year 2017, compared to -1.9% for 2016.

What? The Dow increased 24.4% in 2017 and 13.4% in 2016! Are you telling me that these billion dollar endowments can’t hire investments managers that can beat the Dow? Evidently not. Here’s the 10-year comparison of the average rate of return on endowment investments:

http://www.nacubo.org/Documents/research/2017-NCSE-Public-Tables--Annual-Rates-of-Return.pdf

http://www.nacubo.org/Documents/research/2017-NCSE-Public-Tables--Annual-Rates-of-Return.pdf

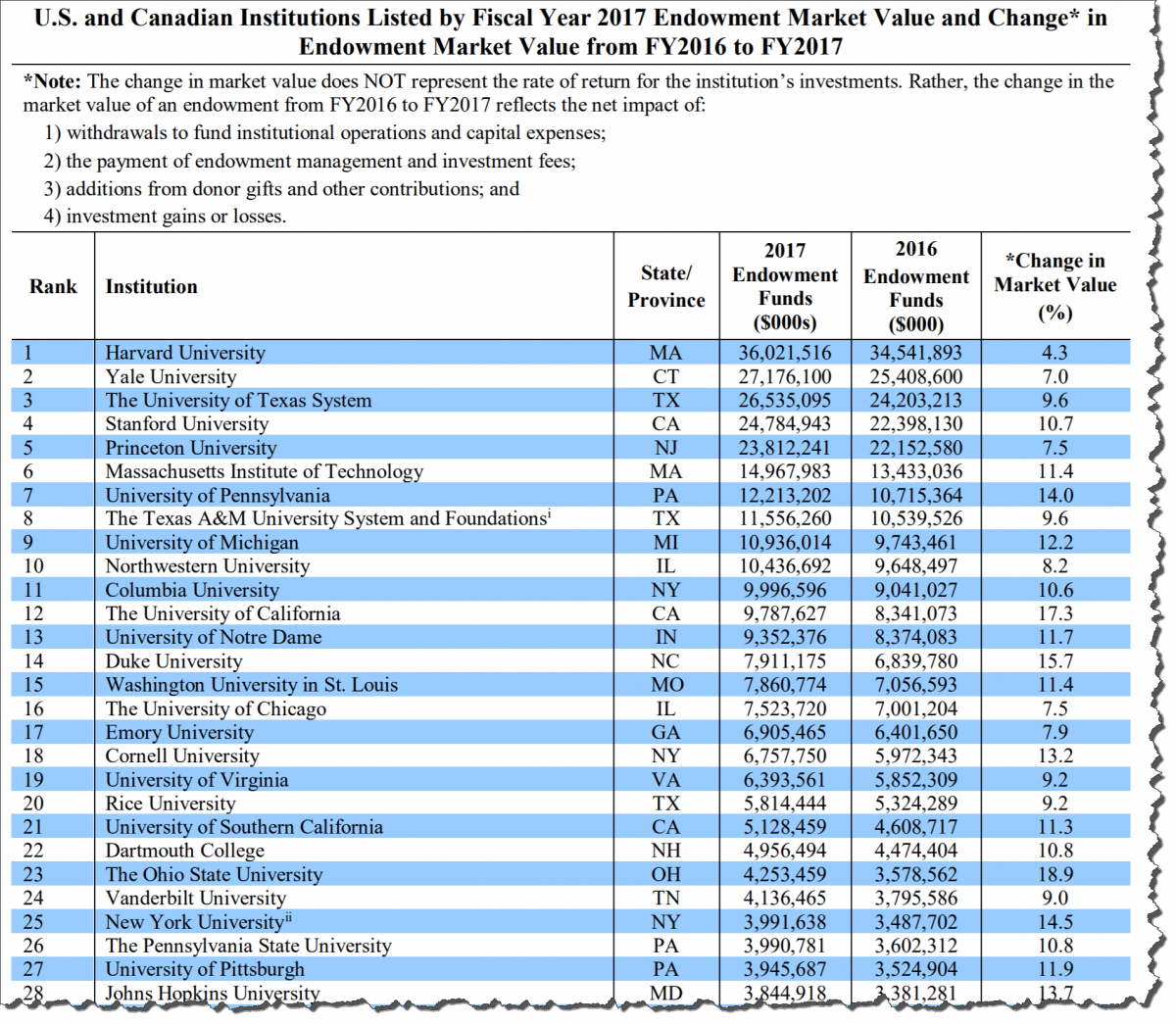

Here’s a real eye-opener! The breakdown of each of the 809 U.S. college endowment funds used in the survey, and the size and percent increase or decrease in their average return from 2016 to 2017. You have to scroll through the list. You can download the full breakdown here. Remember these are "non-profit" institutions and all those zeros are BILLIONS.

http://www.nacubo.org/Documents/research/2017-Endowment-Market-Values-2.pdf

Now let’s take a look at the breakdown of the total market value of the endowments based on the size of the schools:

http://www.nacubo.org/Documents/research/2017-NCSE-Public-Tables--Number-of-NCSE-Participants-2.pdf

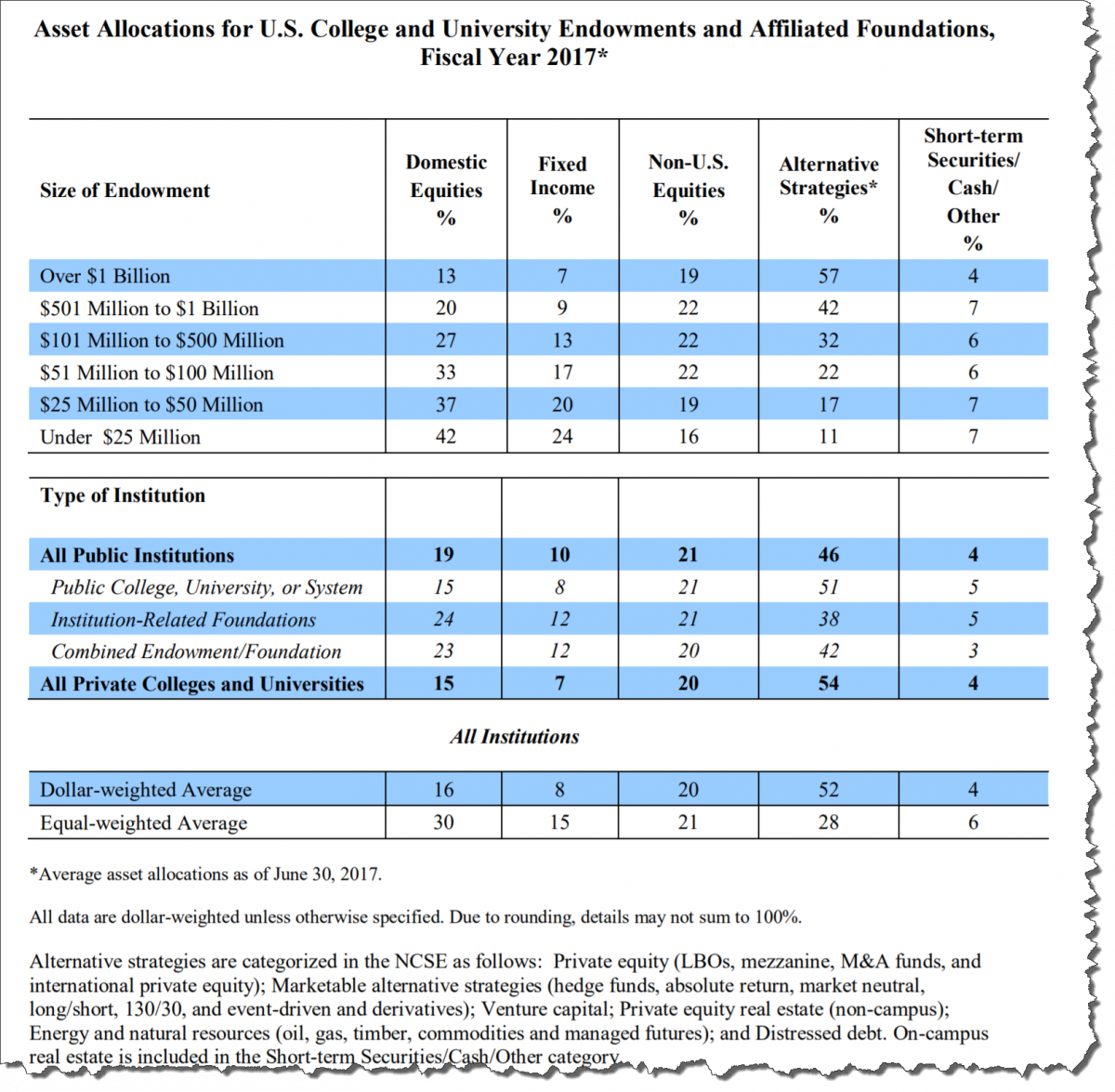

Here we have the five primary asset allocations for investments tracked in the endowment study. Notice the category where the colleges put their endowment money into called “Alternative Strategies”. These are investments that most financial advisors would NEVER put their client’s money into; such as leveraged buyouts, mezzanine debt, distressed property debt, M&A funds, venture capital, hedge funds, long/short (put/call) options, 130/30 strategies, derivatives, commodities and managed futures.

Can you believe it? The largest college endowments in the country (over $1 billion) put an average of 57% of their endowment investments in these potentially risky investments. No wonder they can’t beat the DOW! I’m surprised I did not see Bitcoin on the list. Here’s the NABUCO analysis.

http://www.nacubo.org/Documents/research/2017-NCSE-Public-Tables--Asset-Allocations.pdf

Endowment Data Exposes Why Tuition Prices Don't Need To Increase

There you have it. This data on college endowments exposes how much money they have saved up and what they earn on it. But what about college pricing and endowment size? I mean, why does Harvard raise their tuition costs every year when they have $36 billion in their investment coffers (endowments)? That’s enough money to give every student that attends Harvard a free education for over 200 years!

Havard is just a big one, every college raises their tuition year after year, regardless of endowment size. And now we hear these “non-profit” colleges complaining that they may have to increase their tuition prices even more to offset the new Tax Cuts and Jobs Act hit on their endowments. The provision imposes an annual 1.4% tax on endowments at schools with at least 500 students and endowments of at least $500,000 or more per student.

Lawmakers have criticized that schools like Harvard are hoarding sizable non-taxable endowments that could be used to lower tuition costs or provide more financial aid for students. However, the colleges are all crying the blues, even though, according to the Chronicle of Higher Education, only 30 or so elite, private colleges will be affected.

Anyways, I’ll leave it to all of you to determine who the bad guys are in this scenario. Here is NABUCO's full press release. You should read it and share this information with your clients so they realize that college is a business and it is always about the money.

Posted by Ron Them

He is a former Chief Financial Officer of a Fortune 500 company and currently owns his own financial advisory company specializing in cash flow planning for business owners and executives. He developed the Cash Flow Recovery™ process that uses cash flow management principals to increase asset value and build wealth for business owners.

He is also the originator of several software calculators to help advisors and families make college affordable, including:

* College QuikPlan EFC Calculator

* "Find the Money" College Cash Flow Calculator

* College Debt Reduction Calculator

Ron has been quoted in U.S. News and World Report, Kiplinger's Personal Finance, Smart Money, Financial Advisor Magazine, Small Firm Profit Report, Practical Accountant, LIMRA's Market Facts, Senior Advisors Magazine, HR Magazine, BenefitNews.com, Employee Benefit News Magazine, ProducersWeb.com, Entrepreneur Magazine, Insurance Selling Magazine, CollegeNews.com, The Christian Voice, and Columbus CEO Magazine.